QuadrigaCX, the largest cryptocurrency exchange in Canada, has gone belly up, leaving 115,000 of its customers and all of Canada wondering, “What the hell just happened?”

Some $180 million CAD worth of crypto seemingly vanished when Gerald Cotten, the founder of the exchange, died in India at the age of 30, taking with him the keys to the exchange’s offline cold wallets—which, for Quadriga customers, essentially translates into “all of your money is gone.” The exchange’s customers are collectively owed $250 million CAD in both crypto and fiat.

As is often the case, it’s never a matter of what just happened. If you dig deep enough, you’ll find that the funny business—and there was plenty of it—started long ago.

I’ve cobbled together what I could find on Quadriga and assembled it into a timeline. But before we delve into that, let me introduce you to a few more characters.

Jennifer Robertson is Cotten’s widow, a woman he bequeathed all of his worldly belongings to shortly before his death. In addition to becoming the largest shareholder of Quadriga, she now owns a yacht, an airplane and millions of dollars worth of property—assets that hordes of jilted Quadriga customers feel they now have a right to.

And then there’s Quadriga co-founder Michael Patryn. Some people—actually, a lot of people—believe Patryn is convicted money launderer Omar Dhanani who changed his name to disguise his criminal past after the U.S. deported him back to Canada. I am not saying Patryn is Dhanani. I’ll leave you, the reader, to draw your own conclusion. But I’d be remiss not to include Dhanani’s earlier dealings on my timeline.

Also, a few words on how the exchange handled its banking. Quadriga had no company bank accounts. If you wanted to purchase crypto on the exchange, you would send fiat to one of Quadriga’s third-party payment processors via bank wire, Interac e-transfer or bank draft. Once your fiat was received, Quadriga would credit your account with QuadrigaCX Bucks, a digital stand-in for real dollars, Canadian or USD.

According to the terms of service on the exchange’s website:

“All account fundings are considered to be purchases of QuadrigaCX Bucks. These are units that are used for the purposes of purchasing Bitcoin or other cryptocurrencies. QuadrigaCX Bucks are NOT Canadian Dollars. Any notation of $, CAD, or USD refers to an equivalent unit in QuadrigaCX Bucks, which exist for the sole purpose of buying and selling Bitcoin and other cryptocurrencies.

QuadrigaCX is NOT a financial institution, bank, credit union, trust, or deposit business. We DO NOT take Deposits. We exist solely for the purposes of buying and selling cryptocurrencies.”

Billerfy Labs, owned and operated by a man named José Reyes, was one of Quadriga’s payment processors. Under shell company Costodian, Reyes opened several accounts at Canadian Imperial Bank of Commerce, a top bank in Canada. Quadriga customers would send their money to one of these accounts.

If you wanted to redeem your Quad Bucks, you would send a request to Quadriga. The exchange would then forward that request to Billerfy, which would aggregate withdrawals before moving large sums (say, $100,000 CAD) out of Costodian’s accounts at CIBC to an account held by Billerfy at another bank. And from there, Billerfy would wire the funds directly to you.

In a nutshell, this is how Quadriga moved money. It is also how the exchange got itself into a sticky situation during the crypto boom period of 2017-2018. That is when millions of dollars began pouring into Billerfy/Costodian accounts, arousing the suspicion of CIBC. Banks have to comply with strict anti-money-laundering policies. This makes them strongly averse to anything that looks like, well, money laundering.

And with that, our story actually begins a decade and a half ago.

Timeline

October 26, 2004 — The gig is up for 20-year-old Omar Dhanani. He is one of 28 people arrested in connection with Shadowcrew, an online bazaar for stolen credit and bank card numbers and identity information. These items were bought primarily with E-gold, a digital currency purportedly backed by real gold. Criminals were drawn to E-gold because it allowed them to transfer funds with little more than an email address.

Working out of his parent’s home in Fountain Valley, California, Dhanani served as a moderator on the Shadowcrew forums. He also offered Shadowcrew members an e-money laundering service. Send him a Western Union money order, and for a 10% fee, he would filter your money through E-gold accounts, adding a layer of anonymity to any purchases you planned to make.

On Oct. 4, 2014, going by the pseudonym “Voleur” (French for thief), Dhanani boasted in a chat room that he moved between $40,000 and $100,000 a week, according to a U.S. Secret Service affidavit. He was also known to use the pseudonym “Jaeden.”

(At the time of Dhanani’s arrest, authorities seized $99,402 in USD, $1,858.86 in Western Union money orders, and a 2000 Mercedes Benz CLK320. Most of the cash was taken from the home of Alex Palacio, a reviewer on the Shadowcrew site, who later forfeited the money. But Dhanani later tries to get back the car, the money orders and $4,822 in cash, which was taken from his father’s bedroom.)

October 29, 2004 — After news of the Shadowcrew bust hits the streets, users on Ponzi-promotion forum TalkGold begin discussing the possibility that “Patryn,” a prolific poster on the forum, is actually Omar Dhanani. The majority of the so-called high-yield investment programs on the forum accepted E-gold.

After the Shadowcrew investigation wrapped up, investigators turned their focus on E-gold. In April 2007, the DoJ charged E-gold’s proprietors with money laundering and illegal money transmitting, pretty much spelling the end for E-gold. Nevertheless, E-gold paved the way for other digital currencies, including Liberty Reserve, to take its place in underground economies.

May 9, 2005 — The District Court of New Jersey sets conditions for Dhanani’s pretrial release, which includes a bond for $250,000. His parents, Nazmin and Nabatbibi Dhanani, post equity in their home with the clerk of the District Court for the Southern District of California.

May 18, 2005 — Dhanani is released from custody and free on bail until sentencing.

June 27, 2005 — In a civil forfeiture case related to the $99,402 in cash taken from Alex Palacio, Omar Dhanani and Omar’s father Nazmin, Omar appears to have changed his surname to “Patryn.” (The document reads: “Omar Dhanani aka Omar Patryn.”)

The government argues that the money was derived from proceeds of ID and access device fraud as well as money laundering and are therefore subject to forfeiture. The plaintiffs ask the judge to stay the case until Dec. 30, 2005.

November 18, 2005 — Dhanani pleads guilty to one count of conspiracy to transfer identification documents related to his Shadowcrew arrest. According to court docs, the crime took place from August 2002 to Oct. 26, 2004. (US. DOJ, Indictment, Wired.) Note that Dhanani appears not to have faced charges for operating an E-gold exchanger.

August 24, 2006 — A New Jersey judge sentences Dhanani to 18 months in federal prison and three years supervised release. He is also ordered to pay a fine of $1,000. The court recommends he participate in the Bureau of Prisons Inmate Financial Responsibility Program. (Judgement)

May 23, 2007 — Dhanani is released from prison. (He was likely credited for time served following his arrest in October 2004.)

April 4, 2008 — After the U.S. deports him to Canada, Dhanani returns to doing what he does best: moving money. He registers Midas Gold Exchange in Calgary under “Omar Patryn.” Soon after, Midas Gold launches at M-Gold.com, offering digital currency exchange services.

Midas is a “pre-approved” money exchanger for Liberty Reserve, a Costa Rica-based digital currency service with its own digital currency, LR.

Users could buy LRs for $1 apiece and use them to pay anyone else who had a Liberty Reserve account. Generally speaking, if you wanted to buy LR, you had to go through a middleman, or so-called “exchanger.” M-Gold is such an exchanger. It buys LR bought in bulk from Liberty Reserve and sells LR in smaller quantities, charging 5% on every transaction. By using exchangers, Liberty Reserve was able to avoid collecting ID information on its users.

A number of Midas Gold Exchange customers are displeased with Patryn’s level of service. They register their grievances on Complaints.com.

October 22, 2009 — “Michael Patryn” registers MPD Advertising Inc. in Vancouver, B.C. Nazmin Dhanani is listed as an officer—and we know Na MPD dissolves on Aug. 18, 2013. (Companies of Canada)

May 20, 2013 — Arthur Budovsky, the main man behind Liberty Reserve, is arrested in Spain and charged with running a $6 billion money-laundering enterprise. Cofounder Vladimir Kats is arrested in Brooklyn, N.Y. Other principals are nabbed in Brooklyn and Costa Rica. Three days later, the website libertyreserve.com is seized.

Shortly afterward, U.S. authorities seize more than 30 domains registered as Liberty Reserve exchangers in a civil forfeiture case. M-Gold.com is one of them. According to court docs, “the defendant domain names were used to fund Liberty Reserve’s operations; without them, there would not have been money for Liberty Reserve to launder.”

August 21, 2013 — Michael Patryn and his partner Lovie Horner register World BJJ Corporation in Vancouver. (BJJ stands for Brazilian jiu-jitsu, a form of martial art.) (Government of Canada)

October 31, 2013 — Liberty Reserve co-founder Vladimir Kats pleads guilty to money laundering and operating an unlicensed money transmitter business. (DOJ press release)

While Liberty Reserve may be history, a new digital currency, Bitcoin, is making headlines. Unlike E-gold and LR, Bitcoin is decentralized, making it more difficult to shut down. In a 2015 YouTube video, where he is explaining plans to take QuadrigaCX public, Patryn claims he got involved with bitcoin in mid-2013—just after Liberty Reserve had been shut down.

November 4, 2013 — QuadrigaCX is incorporated in Vancouver, B.C. (The actual operating company is 0984750 BC Ltd.) Patryn is a co-founder along with 25-year-old Gerald Cotten. A big hurdle for Canadian bitcoin exchanges is banking. (Affidavit)

In a later interview with Decentral Talk Live, Cotten explains how there was no easy way to buy bitcoin at the time:

“If you recall, back in the summer of 2013, there really weren’t many options here in Canada for people to buy and sell bitcoins…There was one exchange [Cavirtex] that was pretty much leading the pack….and then, other than that, you pretty much had to send a wire over to Japan [a reference to now-defunct bitcoin exchange Mt. Gox], if you wanted to buy Bitcoin…. You couldn’t hook up your bank account anywhere. It was just such a challenge.”

December 23, 2013 — Just before the platform launches, QuadrigaCX registers as a money services business with the Financial Transactions and Reports Analysis Centre of Canada, or FinTRAC, the country’s anti-money laundering watchdog.

According to Bitcoin Magazine: “While it isn’t strictly required by law, such registration is perceived by banks as a sign of legitimacy, and registration has minimized the number of banking issues [Quadriga] has had to face.”

(FinTRAC doesn’t consider a virtual currency platform a money services business, but that will change on June 1, 2020, when new AML laws take effect.)

December 26, 2013 — QuadrigaCX launches in beta with a staff of five. Website architect Alex Hanin continues to oversee the maintenance of the platform via Connect Development Ltd, a business registered in the U.K. (Georgia Straight)

January 30, 2014 — Boasting 1,000 users, QuadrigaCX moves out of beta. In addition to listing bitcoin, the exchange plans to add dogecoin and litecoin. Cotten boasts that one of the main selling points of his exchange is that users can fund their accounts directly with Interact e-Transfers, a funds transfer service in Canada. “It’s the fastest way to get bitcoins in Canada,” he tells Georgia Straight.

Also on this day, Quadriga launches its first Bitcoin ATM. The Lamassu machine, which sells for $5,000 USD, is installed at Quadriga’s office at 332 Water Street in Vancouver. It’s a one-way ATM, meaning users can deposit cash to buy BTC, but they can’t sell bitcoin for cash on the machine. Cotten’s dream is to open Bitcoin ATMs all over Canada and link them directly to his exchange. (Georgia Straight, CoinATMRadar, YouTube)

“The plan with the ATMs is they’re going to be hooked up to our exchange. So, if someone makes a purchase from our ATM, it makes an equivalent trade on our exchange, which basically refills the ATM instantly. Our plan is to spread our ATMs around Vancouver and not just Vancouver—around the country,” he tells Georgia Straight.

Soon after, Quadriga advertises on its website that it is looking for partners to host Bitcoin ATMs on their premises. (Bitcoin ATMs generally charge high-transaction fees and offer a notoriously easy way for criminals to launder money, especially in Canada, where at this time, no KYC is required for transactions under CA$1,000 per day. It is easy enough to get around this limit, however, by going to to the same machine multiple times in one day.)

May 14, 2014 — In another bank workaround, Quadriga announces that it will accept gold. Users can deposit or withdraw funds from their Quadriga accounts in gold bullion. Patryn tells Bitcoin Magazine: “As we have a great deal of past experience with gold trading, it was not a particularly large leap to enable XBT/XAU trades on our website.”

(It’s unclear what past experience in gold trading Patryn is talking about here, unless he is referring to running E-gold exchangers, such as Midas Gold and the one he operated in 2004 while he was a moderator on Shadowcrew. While it is true, E-gold was purported backed by actual gold, the exchangers were middlemen, who sold E-gold for cash.)

Accepting gold also means that Quadriga now has to actually store the gold. Bitcoin Magazine writes (emphasis mine):

“Anything can be lost or stolen, of course, but QuadrigaCX is big on security. Nobody wants their funds gambled on a fractional reserve system, so all deposits are backed by gold held in their vault, which the directors have years of experience storing and securing. Full details on their storage system are obviously unavailable, but their known security measures are comforting: their office itself lies behind a barred entrance, and neighbors the office of their security company.”

October 6, 2014 — Whiteside Capital Corporation, a shell company linked to QuadrigaCX, is incorporated in British Columbia. The bigger plan taking shape here is that Quadriga wants to go public via a reverse takeover, which is when a smaller private company buys a larger public company. Doing so requires Quadriga to reorganize itself. (Affidavit)

November 12, 2014 — Ancetera Networks LTC., another shell company linked to QuadrigaCX, is incorporated in British Columbia. Since the company’s only purpose is to hold shares, it also has no employees or contractors. (Affidavit)

January 26, 2015 — Ancetera Networks changes its name to Fintech Solutions. Lovie Horner is listed as an executive. Other directors include Anthony Milewski, William Filtness and Natasha Tsai. (BC Laws, Bloomberg, Business Wire)

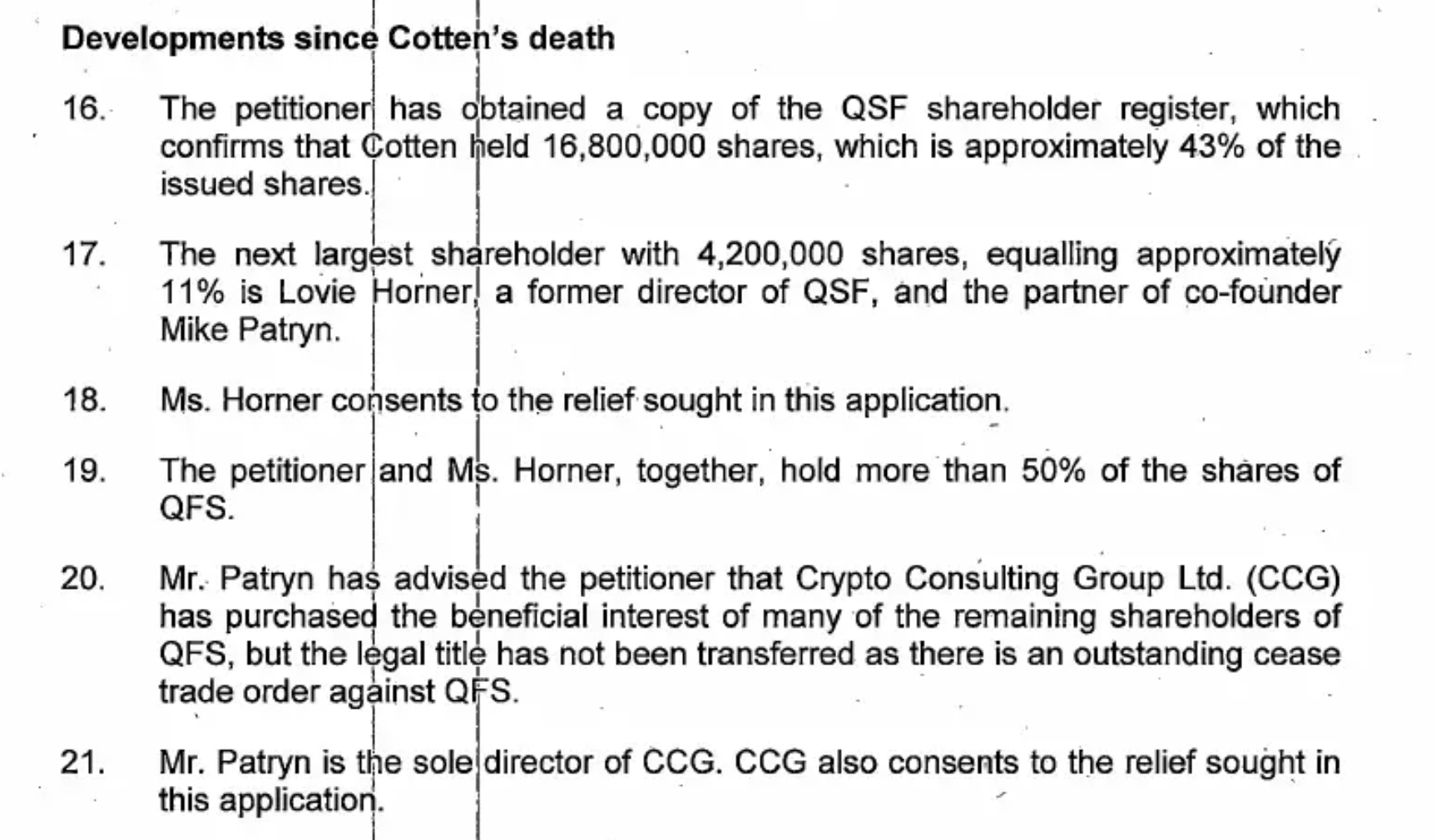

Fintech Solutions holds 40,748,300 shares. Of these, Cotten holds 16,800,000 shares (41.2%); Lovie Horner owns 4,200,000 shares (10.3%); and Crypto Group, a Hong Kong Company, of which Patryn is the sole director, owns 7,095,000 shares (17.4%). (Affidavit)

January 31, 2015 — Despite the positive media coverage, Quadriga is struggling. According to a company prospectus, the trading platform pulled in a mere $22,168 CAD in revenue in the quarter ending Jan. 31, 2015. The company’s net loss for the period was nearly $90,000 CAD.

February 2015 — Unable to grow the company organically, Cotten and Patryn push forward with a plan to take Quadriga public. They raise $850,000 CAD in capital from Canadian brokerage houses Haywood Securities, Jordan Capital Markets, PI Financial, and Wolverton Securities.

February 5, 2015 — According to a listing in S&P Global, Lovie Horner joins QuadrigaCX as VP of business development. She has a background in fashion design.

February 23, 2015 — Two of Canada’s biggest crypto exchanges shutter, making Quadriga the largest in Canada. Vault of Satoshi closed on Feb. 17, and Cavirtex announces plans to wind down by March 25. (Bitcoin Magazine) Cavirtex ends up being absorbed by Kraken, a U.S. crypto exchange.

March 3, 2015 – Quadriga officially announces its plans to go public in a reverse takeover of Whiteside Capital, a shell company set up in October 2014.

In an episode of the #BlockTalk podcast, Patryn explains that a reverse takeover will eliminate the paperwork involved with getting listed the usual way—via an IPO. The exchange is set to trade under “Quadriga Fintech Solutions.” Public trading is expected to commence with the Canadian Securities Exchange by early April.

Quadriga boasts it will undergo a full financial audit by Wolrige Mahon LLP. “We’re excited to be able to provide an unparalleled level of transparency by merging legacy financial audits with innovative blockchain technology,” Cotten tells Bitcoin Magazine.

After the big announcement, things quickly go downhill. Quadriga burns through all of its investment capital, and Patryn brings a lawsuit against Robert Lawrence, the Vancouver businessman he enlisted to help take the company public.

Globe and Mail, which reviewed the court documents, writes:

“In Mr. Patryn’s telling, Mr. Lawrence failed to perform his duties properly and the company was never able to list. Mr. Lawrence raised a total of $850,000, of which $150,000 came from Mr. Patryn. But by June, 2015, the company had run out of money and lost 45 percent of its market share, according to Mr. Patryn’s statement of claim. Mr. Patryn said much of the money had to be spent correcting the “poor quality” of Mr. Lawrence’s work. Investors pitched in another $600,000, including $200,000 from Mr. Patryn, to keep the company from failing.

By February, 2016, Quadriga gave up on its plans to list and severed its relationship with Mr. Patryn, he said in court documents, owing to his perceived association with Mr. Lawrence. “News of his termination from QCX has materially and negatively affected his ability to secure similar work in the financial technology industry,” Mr. Patryn’s statement of claim read.

In a response, Mr. Lawrence denied the allegations and said Mr. Patryn approached him, not the other way around. Moreover, Quadriga’s failure was its own fault – and Mr. Patryn was the company’s “controlling mind,” he asserted. (Mr. Cotten is scarcely mentioned in the lawsuit.) Mr. Lawrence sought to have it dismissed. No filings have been made in the case since 2016. Mr. Lawrence could not be reached for comment.”

April 14, 2015 — With great enthusiasm, Quadriga renews plans to install Bitcoin ATMs across Canada. A fleet of new SumoPro two-way bitcoin ATMs is on its way from supplier BitXatm. Two-way, means users will be able to both buy and sell crypto on the machine. Quadriga says the new units will be delivered in batches of five in several major cities, including Vancouver, Toronto, and Montreal. (BitXatm tweet)

According to Bitcoin Magazine, QuadrigaCX already has more than 40 Bitcoin ATM machines across the country. And the plan was to add more. Journalist Christie Harkin writes: “Like most other independently owned bitcoin ATMs across Canada, these machines will trade on the QuadrigaCX platform. These new BitXATM machines also will be modified to allow for direct cash deposits and withdrawals from customers’ Quadriga CX balances.”

September 29, 2015 — According to SEDAR, a system for filing securities documents with Canada’s regulators, QuadrigaCX publishes its last “certification of interim filings.” In other words, its last financial audit.

November 12, 2015 — Quadriga announces the formation of a blockchain R&D lab in partnership with Christine Duhaime, an “anti-money laundering expert,” according to her website. However, like past Quadriga projects, this one is long on hot air and short on follow through. According to a press release, the lab’s first task is to develop a “platform with two core functions: handling the onboarding and client data management for financial crime systems using the Blockchain and facilitating machine to machine (M2M) payments with Internet of Things (IoT) providers for connected cities.”

(Note: According to an article she wrote for Coindesk in March 2019, Duhaime said she was hired in 2015 as the exchange’s regulatory attorney to help draft a statutory prospectus, meaning a legal document that describes a security to investors. She was terminated after six months, she said, “because QuadrigaCX executed a management hard fork overnight, which started the company down a path of lawlessness.”)

December 2015 — Cotten sets up the famed Chris Markay account on Quadriga. It is a fake account operated by him. Initially, Cotten funds the account with fake dollars and uses it to purchase real bitcoin from Quadriga customers. (OSC report)

February 29, 2016 — At this juncture, Patryn has supposedly left Quadriga and split ways with Cotten. The reason, he tells the Globe and Mail, is because he disagreed with Cotten’s decision to call off listing the company. Quadriga makes a passing mention on Reddit that Patryn is gone; otherwise, there is no formal announcement. On the heels of Patryn’s departure, Quadriga directors Anthony Milewski and Lovie Horner also resign. (Business Wire)

March 8, 2016 — QuadrigaCX is banned from selling securities altogether when the British Columbia Securities Commission issues a cease trade order. Apparently, Quadriga has not submitted a financial audit for the year ended Oct. 31, 2015. A “Management’s Discussion and Analysis” is also missing, according to the order.

March 18, 2016 — Director William Filtness and Chief Financial Officer Natasha Tsai step down from QuadrigaCX. From here on out, Gerald Cotten is a one-man band, managing the majority of work from his laptop, wherever he happens to be. The servers are in the cloud on Amazon Web Services. According to court documents filed in January 2019, he also “took sole responsibility” for handling the exchange’s virtual currency.

November 3, 2016— Quadriga enters into an agreement with Billerfy, a third-party payment processor run by José Reyes. (Interpleader order, archive)

November 30, 2016 — Quadriga allows its FinTRAC registration to lapse. (The exchange registered with the Canadian regulator in 2013, even though, according to laws at the time, it was not required to do so.)

February 2017 — Cotten registers an upscale Cessna 400. The plane’s market price at the time is about half a million Canadian dollars. Cotten is a pilot, but the airplane ends up sitting on the runway, barely used. While it only costs about $50 a month to tie down a plane at Debert Airport in Nova Scotia, Cotten was always behind on bills. (Globe & Mail)

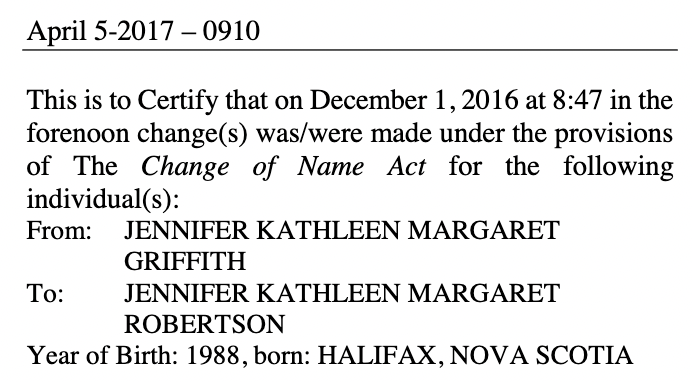

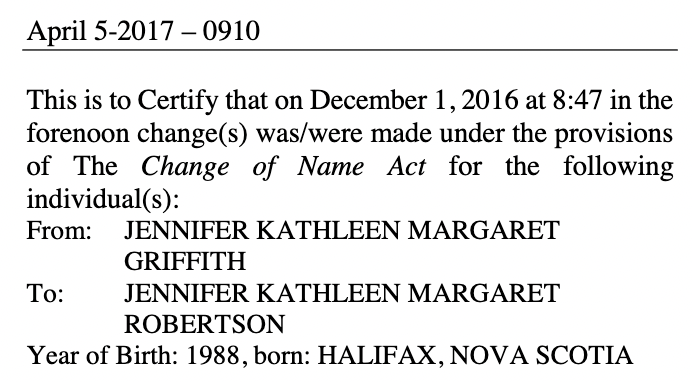

April 5, 2017 — Cotten’s partner, Jennifer Kathleen Margaret Griffith, changes her last name to Robertson. (Royal Gazette)

April 5, 2017 — Cotten’s partner, Jennifer Kathleen Margaret Griffith, changes her last name to Robertson. (Royal Gazette)

According to CBC, she has also used the name “Jennifer Forgeron” in the past.

Nobody knows for sure why she changed her name to Robertson.

June 2, 2017 — Quadriga announces on Reddit that it has lost some 67,000 ether worth $14.7 million USD due to a software glitch. The Ethereum contract is known, confirming the money is stuck in Cotten’s wallet, not stolen. The exchange writes:

“While this issue poses a setback to QuadrigaCX, and has unfortunately eaten into our profits substantially, it will have no impact on account funding or withdrawals and will have no impact on the day to day operation of the exchange.”

About this same time, according to court documents filed two years later, Quadriga’s “Chris Markay” account—an alias controlled by Gerald Cotten—is credited with $100 million fake bucks.

July 18, 2017 — Despite his company’s recent financial setback, Cotten manages to register his 51-foot yacht, The Gulliver. The boat features three cabins, a six-person dining area , a dishwasher, a gas stove, a washer and dryer, an en-suite bathroom with a standing shower, along with a swim platform with teak battens.

Cotten bought the boat from Sunnybrook Yachts after telling the salesperson he wanted something that could take him to the Caribbean without having to stop in Canada or the U.S. for gas. (Vanity Fair)

Meanwhile, Bitcoin is in the midst of its biggest bull run yet. In mid-2017, one BTC was worth about $2,500 USD. By Christmas, it would be valued at eight times that. Yet, even as Quadriga was acquiring more customers, and making more money than ever on trades, there were signs of trouble brewing.

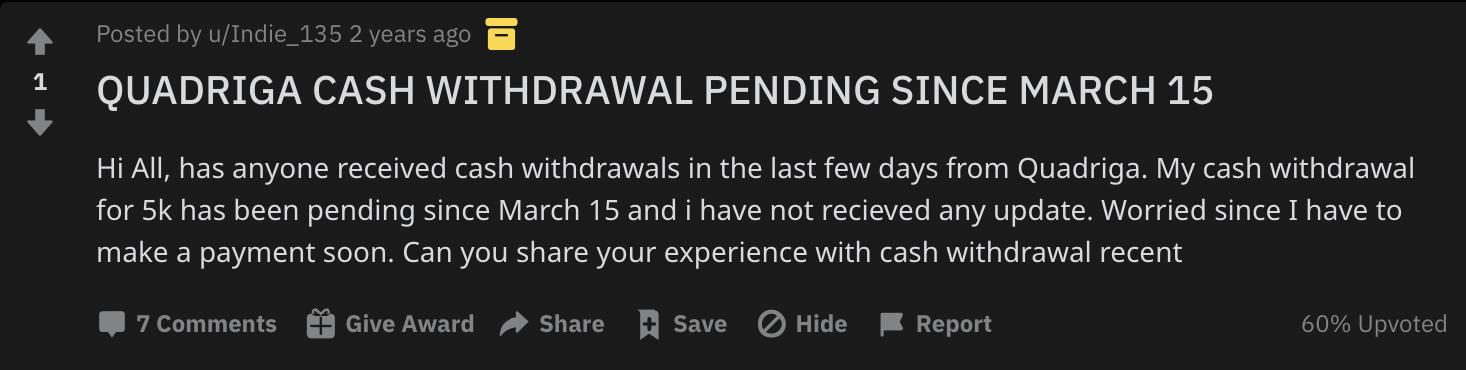

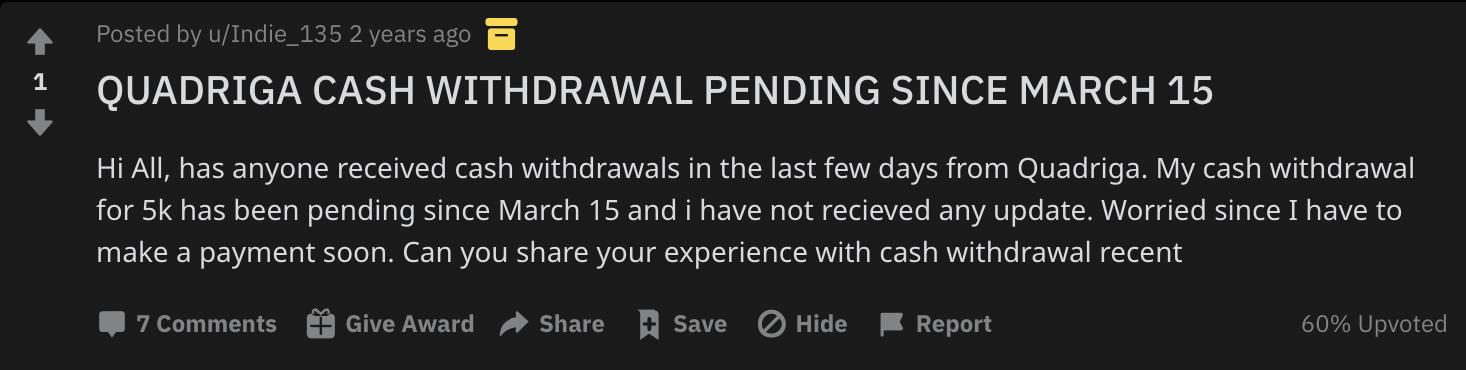

August 21, 2017 — Quadriga customers begin reporting delays in getting cash off the exchange. (What they see in their accounts are Quad Bucks, a stand-in for fiat money. But many Quadriga customers don’t know this.) In emails with clients, Cotten blames the “Canadian banking cartel” for the wire delays, saying they are out to “stifle bitcoin adoption” in the country. (Globe and Mail)

September 26, 2017 — On behalf of Billerfy, the payment processor he operates and that services QuadrigaCX, José Reyes applies to open three commercial banking accounts at the Canadian Imperial Bank of Commerce’s Beaver Creek Branch. (Interpleader order)

September 27, 2017 — Reyes visits the CIBC Bayview Village Branch, and opens personal checking, savings and U.S. dollar accounts. (Interpleader order)

November 28, 2017 — CIBC’s anti-money laundering department reviews Reyes’ account opening documentation at the Beaver Creek Branch. After the bank learns that Billerfy is a money service business, it closes the accounts. (Interpleader order)

November 30, 2017 — Reyes applies to open two small business banking accounts at CIBC’s Bayview Village Branch on behalf of Costodian, a shell company he set up to open accounts under. One is an “expense account,” the other is a “transaction account.” Reyes tells CIBC that Costodian is “[n]ot related to Billerfy’s CMO business.” (Interpleader order)

December 17, 2017 — After a spectacular run-up, bitcoin reaches an all-time high of nearly $20,000 USD. In 2017, $1.2 billion USD worth of bitcoin traded on Quadriga. The exchange took a commission on every trade. (But as court docs reveal, Quadriga kept no books, had no formal record of accounting, and business and customer funds were all mixed together.)

December 4 – February 20, 2018 — At the height of the crypto bubble, tens of millions of dollars flood into the bank accounts that Reyes opened up at CIBC to collect Quadriga funds. In three months, 388 depositors make 465 deposits to Costodian’s “transaction account” in the total amount of $67 million CAD. (Some of the money is eventually withdrawn, leaving roughly $26 million CAD.)

December 22–28, 2017 — Reyes transfers $2.3 million CAD from Costodian’s “transaction account” to his personal checking and savings accounts. He admits to CIBC he did not notify Quadriga prior to transferring the money to his personal accounts. From here out, the bank takes a hands-off approach to those funds. (Interpleader order)

January 8, 2018 — CIBC is unsure of who the $26 million CAD belongs to, so it freezes two accounts belonging to Costodian and José Reyes. In an interpleader order, the bank asks the justice system to take possession of the funds and decide who they belong to—QuadrigaCX, Costodian or the depositors. Cotten fights back, claiming CIBC had no right to freeze the funds. Quadriga has already credited depositors with Quad Bucks, he says.

In 2018, the bitcoin bubble bursts. According to official reports, by the end of 2017, there were some 20,000 fake bitcoin on Quadriga. Clients have no idea they have been paying cash for fake crypto. As market prices plummet, when customers go to sell their bitcoin, Cotten struggles to come up with the money to cover it. The issues with CIBC only compound the problem.

February 8, 2018 — According to the Globe and Mail, a new company, 700964 NB, is registered in New Brunswick as “part of a network of entities that helped move millions of dollars around so Quadriga could take deposits and facilitate withdrawals, sometimes in the form of physical bank drafts, for its clients.” Aaron Matthews, Quadriga’s director of operations, and Sarah-Lynn Matthews, his wife, are listed as owners, but the address on the registration leads to a rickety trailer in a mobile home park.

February 16, 2018 — CIBC is still trying to sort out who the $26 million CAD belongs to. The bank asks Jose Reyes (the person who controls the frozen accounts) if it is okay to speak to someone at Quadriga. Reyes says no, because Cotten had indicated that he was not interested in speaking with anyone at CIBC. (Interpleader order)

March 6, 2018 — Reyes finally gives CIBC the okay to contact Cotten directly. (Interpleader order)

March 15, 2018 — CIBC dashes off an email to Cotten asking to speak with him briefly by phone. Cotten declines and requests that CIBC only send him questions in writing. (Interpleader order)

March 21, 2018 — CIBC emails Cotten questions regarding the relationship of Quadriga with Costodian/Billerfy and the depositors and Quadriga’s entitlement to the disputed funds. Neither Cotten nor anyone else from Quadriga responds. (Interpleader order)

Meanwhile, Quadriga clients start complaining on Reddit that their cash withdrawals are delayed.

Meanwhile, Quadriga clients start complaining on Reddit that their cash withdrawals are delayed.

July 2018 — In the midst of all this, Michael Patryn is working on cleaning up his reputation. He hires Reputation.ca to remove negative content about him on Complaints.com, where he is referenced as a money launderer. Patryn later sues Reputation.ca for not moving fast enough, according to the Globe and Mail, who reviewed the court documents.

October 8, 2018 — Cotten and Jennifer Robertson get married, according to several Reddit posters who claim they saw Robertson’s Facebook page. (The Globe and Mail earlier reported the wedding was in June. However, the OSC report also confirms the wedding was in October.) According to the OSC report, it was a small private ceremony in Scotland.

November 9, 2018 — The Ontario Superior Court grants CIBC an interpleader order allowing the court to take control of Custodian’s $26 million CAD—which it is holding on behalf of Quadriga—until the ownership of the funds can be established. (CoinDesk.)

November 27, 2018 — Cotten signs a will, leaving all his belongings to Robertson, including several properties, a 2017 Lexus, an airplane, a 2015 Mini Cooper and a 51-foot Jeanneau sailboat. He goes a step further and details the distribution of his assets should Robertson not survive him, even specifying that $100,000 CAD goes to his two chihuahuas, Nitro and Gully.

After some digging, CBC learns that Cotten’s widow has a company called Robertson Nova Property Management, which was incorporated in June 2017. Between May 2016 and October 2018, Robertson, her husband and her company bought 16 properties worth $7.5 million CAD. The properties range from $94,000 CAD for a waterfront lot in Lunenburg County to $2.5 million CAD for nine row houses in Bedford.

“Little is known about Ms. Robertson, who appears to have used three different surnames since she began buying real estate in Nova Scotia with Mr. Cotten in 2016,” reports Globe and Mail in February 2019.

November 30, 2018 — Cotten and wife Jennifer Robertson arrive in New Delhi, India. They have come to the country to celebrate their honeymoon and participate in the opening of an Angel House orphanage they sponsored. (Globe and Mail)

December 3, 2018 — Physical cash pickups up to $2,500 are now available for Quadriga customers. Quadriga states on Reddit (archive): “We have partnered with selected stores to provide local cash pickup — as we have just started exploring this new method, only one store in Montreal, QC has been set up at the moment. We have another store going live next week in Cornwall, ON and hopefully many more.”

December 4, 2018 — Quadriga announces that the Ontario Superior Court is releasing the Costodian funds, which CIBC held “hostage.” Quadriga writes on Reddit (archive): “According to our counsel, the funds should be paid out by the end of this week.” However, new problems arise when the court issues the funds back to Costodian in the form of bank drafts, which Custodian has trouble depositing. No bank will touch the money.

(By this time, according to official reports, Cotten has lost a total of $115 million CAD trading on the platform by trading with fake assets. So far, he has covered those losses with customer money. Now, with another $26 million CAD that has become inaccessible, he is running out of time. His Ponzi is collapsing.)

December 8, 2018 — At 5:15 p.m. Cotten and Robertson land in Jaipur, India, where they plan to spend four nights at the Oberoi Rajvilas for $923 CAD a night. Soon after the couple check-in, Cotten gets a bellyache. At 9:45 p.m., he checks into Fortis Escorts Hospital. He spends the night at the hospital in a private room. (Globe and Mail)

December 9, 2018 — Cotten’s condition deteriorates. At 7:26 p.m. local time he is declared dead due to complications of Crohn’s disease. The cause of death is cardiac arrest. Robertson withholds the news from Quadriga customers for more than a month. Meanwhile, the exchange continues to accept deposits. (Globe and Mail, Affidavit)

December 10, 2018 — Dr. Simmi Mehra, who works at Mahatma Gandhi Medical College & Hospital, refuses to embalm Cotten’s body, in part because the body was coming from the hotel where Cotten had been staying—not Fortis, the hospital where he died. Most bodies are brought to her by ambulance, she said. Additionally, she is uncomfortable with the lack of detail and documentation surrounding the death.

December 10, 2018 — Cotten’s body is then taken to SMS Medical College, which issues an embalming certificate. Sangita Chauhan, who heads the anatomy department there, does not actually see the body. Instead, a junior staffer handles the processing. The body is picked up by staffers at Oberoi, the hotel where Cotten and his wife were staying. (Globe and Mail)

December 10, 2018 — Robertson checks out of the Oberoi and heads back to Canada “with the body,” according to the Globe and Mail. She arrives in Halifax the following day.

December 13, 2018 — Cotten’s death is registered with the Government of Rajasthan Directorate of Economics and Statistics in India. “The death certificate, obtained by The Globe, lists his “address at time of death” as the Oberoi Rajvilas.” However, a death certificate, later obtained by CoinDesk, lists his “place of death” as Fortis Escorts Hospital.

December 13, 2018 — The Angel House orphanage that Cotten and Robertson funded opens in Venkatapuram, India. The money the couple donated only paid for materials. The building is still missing several doors, including one to the bathroom. And the man running the orphanage is going into debt.

December 14, 2018 — A closed-casket funeral service is held for Cotten at J.A. Snow Funeral Home in Halifax, Nova Scotia. He is buried that day. (Reddit)

Meanwhile, withdrawals from Quadriga have all but ground to a halt. Reddit /r/QuadrigaCX has become awash with people complaining they cannot get their money out of the exchange. (David Gerard)

January 14, 2019 — Quadriga finally lets the world know that its CEO is dead. Cotten’s widow posts an announcement on the Quadriga website explaining that Cotten passed away in India while opening an orphanage. To quell any suspicions that he ran off with everyone’s money, she bestows her husband with a host of virtuous qualities:

“Gerry cared deeply about honesty and transparency—values he lived by in both his professional and personal life. He was hardworking and passionate, with an unwavering commitment to his customers, employees, and family.”

Robertson recommends that Quadriga’s head of operations, Aaron Matthews, assume the role of interim president and CEO. Matthews later denies he was CEO. (Tweet)

Meanwhile, Quadriga’s customers are now having trouble getting their crypto out of the exchange. Unlike cash, which has to go through a third-party payment processor, crypto should move directly from the exchange to the customer. This leads to concern that maybe the crypto funds aren’t actually there.

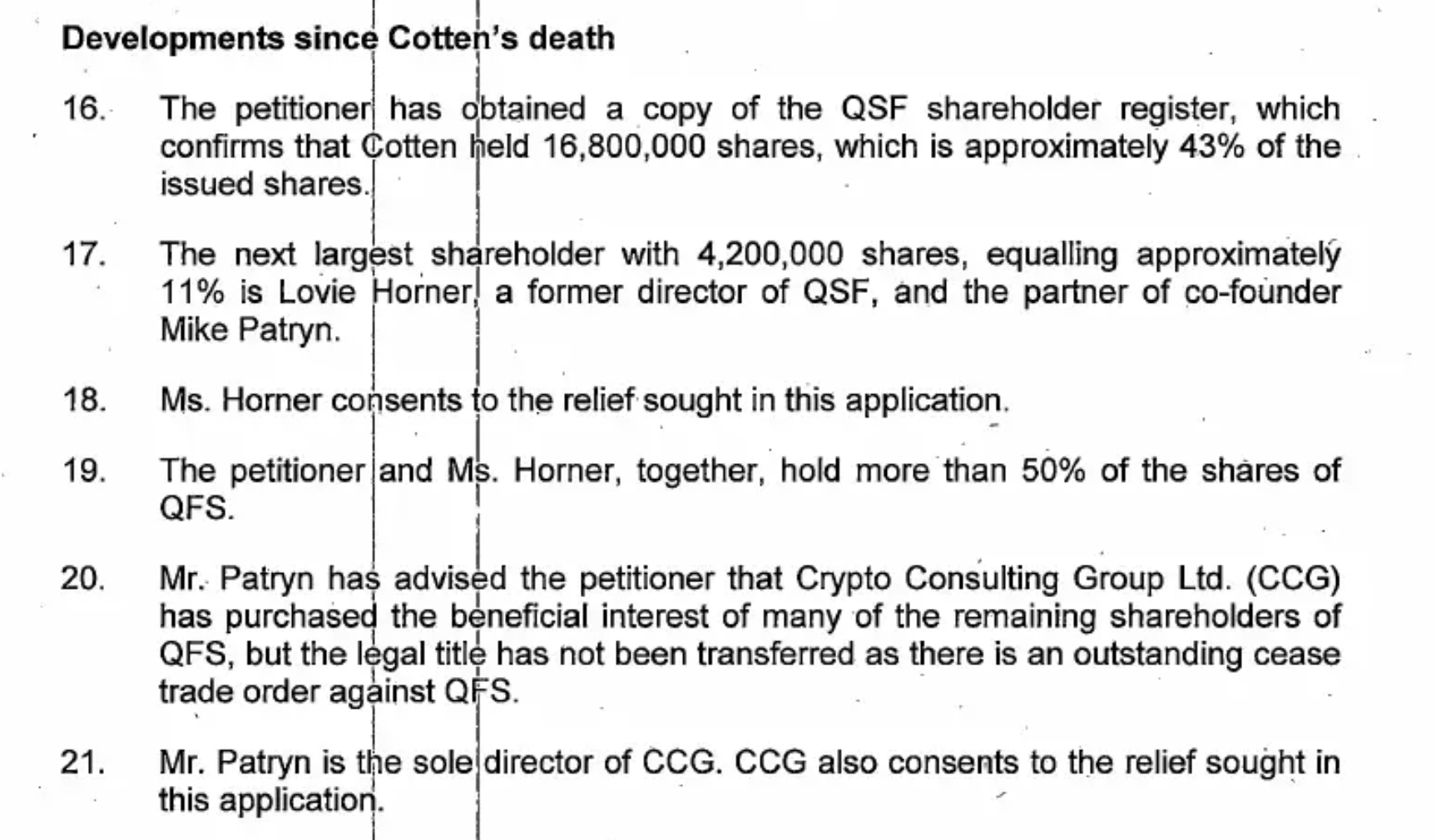

January 22, 2019 — Robertson sends a petition to the Supreme Court of British Columbia requesting a shareholder meeting to appoint new board members to Quadriga Fintech Solutions because, effectively, the company has no board. Per the petition, the owners of QFS are Cotten (43%), Lovie Horner (11%), and Mike Patryn (who had purchased most of the rest), with some other minor shareholders.

January 22, 2019 — Robertson sends a petition to the Supreme Court of British Columbia requesting a shareholder meeting to appoint new board members to Quadriga Fintech Solutions because, effectively, the company has no board. Per the petition, the owners of QFS are Cotten (43%), Lovie Horner (11%), and Mike Patryn (who had purchased most of the rest), with some other minor shareholders.

January 25, 2019 — It’s Friday. Quadriga holds a shareholder meeting. Robertson, her stepfather Thomas Beazley, and a man named Jack Martel are appointed as new directors. They decide to suspend Quadriga’s operations but hold off on sharing this news with Quadriga customers. (Affidavit)

January 26, 2019 — The newly appointed directors instruct that the platform be paused. According to an affidavit Robertson files with the court on Jan. 31, “The pause will mean that future trades of cryptocurrency will be temporarily suspended, including the settlement of cash or the trading of currency between users.”

January 28, 2019 — All weekend long, anxious Quadriga customers wait to hear some news. On Monday, they awake to find a large notice on the exchange’s website indicating the site is down for maintenance. (CoinDesk)

January 29, 2019 — Cotten’s widow moves to protect her property. According to the Chronicle Herald, at the end of January, “Robertson took her deceased husband’s name from the ownership of four properties, worth a combined $1.1 million [CAD], then took out collateral mortgages on all four in favour of a trust of which she is a trustee, and finally transferred ownership of at least two of those properties to that trust.” The name of the trust is the Seaglass Trust.

January 31, 2019 — Quadriga’s anxious customers still don’t know what is going on. The exchange’s website remains in “maintenance mode” for three nail-biting days. Then a new notice appears on the site, basically stating Quadriga customers’ worst fears: the exchange is bankrupt. Quadriga’s board members have applied for creditor protection with the Nova Scotia Supreme Court. A preliminary hearing is set for Feb. 5.

Buried in the notice is more alarming news. Quadriga is scrambling to locate the keys to its cold wallets. Most exchanges typically keep the majority of their crypto in offline “cold” wallets for security reasons. The situation is akin to a bank misplacing all of its money—or worse, the money getting stuck in a vault and the only person with the key is dead.

February 5, 2019 — Maurice Chaisson, a lawyer with Stewart McKelvey, represents Quadriga in a Nova Scotia court for its creditor protection hearing. The court appoints Ernst & Young as a monitor in charge of tracking down the $250 million CAD, in cash and in crypto, collectively owed to Quadriga’s customers. The exchange is granted a 30-day stay, meaning its clients are unable to sue the exchange in that time. (CoinDesk)

Quadriga updates its website with a new announcement and a Q&A explaining what it means to file for creditor protection under the Companies’ Creditors Arrangement Act.

February 5, 2019 — With keys to the exchange’s cold wallets supposedly gone missing, many are wondering if Cotten staged his death. CoinDesk posts a death certificate with Cotten’s name misspelled “Cottan.” Apparently, fake death certificates are easy to come by in India.

February 7, 2019 — Fortis Escorts, the hospital in Jaipur, India where Cotten passed, releases a statement confirming his death. Cotten arrived at the hospital in a “critical condition” with “pre-existing Crohn’s disease and was on monoclonal antibody therapy every 8th week.” He was diagnosed with septic shock and other horrible things. (CoinDesk)

February 8, 2019 — CoinDesk reports that crypto funds were moving through the Quadriga platform up to Cotten’s death. In a series of transactions sent from the exchange’s internet-connected hot wallets, more than 9,000 ETH moved from Quadriga to a handful of other exchanges, including Binance, Bitfinex, Kraken and Poloniex. Most of that crypto was transferred the week before Cotten’s death, but there is no telling who initiated the transactions—the exchange, its customers, or both.

February 8, 2019 — The Ontario Securities Commission, or OSC, announces it will look into what happened at Quadriga. . The news comes just days after the British Columbia Securities Commission said it had no reach into the exchange. (Reuters.)

February 11, 2019 — Jack Martel, one of the newest member of Quadriga’s board resigns, leaving Jennifer Robertson and her stepfather Thomas Beazley as the only two directors. (Second report of the monitor.)

February 12, 2019 — Things just keep getting worse for Quadriga creditors. In its initial report, the monitor reveals that on Feb. 6—a day after Quadriga was granted creditor protection—the exchange “inadvertently” sent 104 of the bitcoin it was holding in its hot wallets (worth roughly $468,675 CAD) to its dead CEO’s cold wallet, which nobody can access.

The hot wallets now contain 51 bitcoin (BTC), 33 bitcoin cash (BCH), 2,032 bitcoin gold (BTG), 822 litecoin (LTC), and 951 ether (ETH), worth $434,068 CAD—less than half the value of what they held before.

February 14, 2019 — Nova Scotia Supreme Court Judge Michael Wood appoints law firms Miller Thomson and Cox & Palmer to represent Quadriga creditors throughout the CCAA proceedings. Miller Thomson is the lead counsel located in Toronto; Cox & Palmer is the local counsel. The scope of their work is spelled out here.

February 20, 2019 — In its 2nd Report of the Monitor, Ernst & Young reveals that the sending of 104 BTC to Quadriga’s cold wallets earlier was due to a “platform setting error.” The CCAA process is also running low on funds. EY has in its possession tens of millions of dollars in bank drafts from Quadriga and its payment processors. The problem is getting a bank to accept the funds. (Read my story here.)

February 22, 2019 — The court issues a “Banking arrangement order” at the request of Ernst and Young. The order offers limited protection to the Bank of Montreal and the Royal Bank of Canada for handling bank drafts related to Quadriga and its payment processors.

There is also an issue of a a disputed $5 million CAD bank draft—EY has determined that $60,958.64 CAD of that is owed to Costodian principal Jose Reyes, because these were his personal funds. And $778,213.94, which Custodian claims it is owed in unpaid transaction fees, will go into trust account pending further order of the court.

February 25, 2019 — Robertson files a second affidavit. In it, she asks for an extension of the stay of proceedings in the CCAA and the appointment of Peter Wedlake, a senior vice president and partner at tax and accounting firm Grant Thornton, to the position of chief restructuring officer for Quadriga. The CRO would fill the director position left vacant by Jack Martel stepping down on February 11. Thornton has cryptocurrency experience and is a “certified bitcoin professional.“

February 28, 2019 — Globe and Mail (archive) tracks down a booking photo of Omar Dhanani and posts it alongside a screen grab of Michael Patryn taken from a Youtube video. The two faces look strikingly similar.

February 28, 2019 — Globe and Mail (archive) tracks down a booking photo of Omar Dhanani and posts it alongside a screen grab of Michael Patryn taken from a Youtube video. The two faces look strikingly similar.

March 5, 2019 — Justice Michael Wood grants Quadriga a 45-day stay and approves the appointment of Peter Wedlake as chief restructuring officer. (My coverage here and here.)

March 13, 2019 — The law firm representing Quadriga in the CCAA proceedings tells the court that it is stepping down, effective immediately. Stewart McKelvey had been representing both Quadriga and the estate of Quadriga’s dead CEO. This led to concerns of a potential conflict of interest from the monitor and the representative counsel. Stewart McKelvey will continue to represent Robertson’s estate.

March 19, 2019 — Bloomberg straight out announces that Michael Patryn is Omar Dhanani. Reporters tracked down the actual documents showing two name changes. “Patryn changed his name from Omar Dhanani to Omar Patryn with the British Columbia government in March 2003. Five years later, he registered a name change to Michael Patryn in the same Canadian province.” There is no doubt now of Patryn’s true past and identity.

March 19, 2019 — The representative counsel in Quadriga’s CCAA now have a voice to listen to. Miller Thomson and Cox & Palmer appoint a steering committee to help them represent 115,000 of the exchange’s creditors. The members include: Parham Pakjou, David Ballabh, Eric Bachour, Ryan Kneer, Magdalena Gronowska, Eric Stevens and Nicolas Deziel, with Richard Kagerer and Marian Drumea assigned as alternates.

April 2, 2109 — EY releases its fourth monitor report. The monitor proposes that Quadriga shift from its Companies’ Creditor Arrangement Act proceedings into proceedings under the Bankruptcy and Insolvency Act.

EY is moving to preserve Robertson’s assets, so that she can’t liquidate or transfer them. The monitor is also grappling with a host of former Quadriga third-party payment processors to track down more missing money.

April 8, 2019 — Quadriga is officially placed into bankruptcy. The transition means EY will be granted enhanced investigative powers as a trustee.

April 18, 2019 — Justice Wood extends Quadriga’s creditor protection to June 28. On that date, the CCAA proceeding will expire and Quadriga will enter a pure bankruptcy.

May 10, 2019 — EY publishes its trustee’s preliminary report. The report is dated May 1, but looks to have been published several days later. It reveals what many Quadriga creditors likely already know — most of their money is gone. Quadriga has US$21 million but owes creditors US$160 million.

June 19, 2019 — Quadriga’s publishes its fifth report of the monitor, and it is a doozy. The report begins to draw a clear picture of the huge fraud that was taking place inside the exchange. Most notably, it describes how millions of dollars worth of funds were funneled off the exchange via slush accounts set up by Gerald Cotten himself. The biggest is the “Chris Markay” account.

The numbers are somewhat different than earlier. According to EY, the exchange owed 76,000 users (not 115,000) $215 million CAD (not $250 million CAD) in fiat and crypto. So far, only $33 million CAD has been recovered. (My story in Decrypt)

August 26, 2019 — In a second report of the trustee filed with the Supreme Court of Nova Scotia, EY notes that there are now four law enforcement agencies and regulators requesting information about Quadriga. It reveals two: the Royal Canadian Mounted Police and the FBI. The identity of the other two remains undisclosed, though Coindesk reports that one may be an Australian investigative agency and a later story in Vanity Fair suggests one is a federal agency in Japan.

Separately, EY also recommends moving Quadriga’s ongoing bankruptcy proceedings from Halifax to Toronto to reduce costs. “As the majority of the professionals are located in Ontario, there would be significant cost savings to transferring the proceedings to Ontario,” the auditor said. “There are very few remaining ties to Nova Scotia at this time.”

September 10, 2019 — A Nova Scotia judge approves the request to move the Quadriga bankruptcy process to Toronto. The court proceedings for the shuttered exchange have been held in Halifax since January 2019, following its founder’s untimely death.

October 7, 2019 — EY files its fourth report of the trustee. Jennifer Robertson, Cotten’s widow, agrees to turn over roughly CA$12 million (US$9 million) in assets to EY Canada. In a statement, she said she had “previously thought [the assets] were purchased with Gerry’s legitimately earned profits, salary and dividends.”

Robertson’s, stepfather, Thomas Beazley, will also transfer to EY any assets he bought with money that came from Quadriga, including a 2017 Toyota Tacoma truck.

Meanwhile, Robertson will get to keep her clothing and personal items, her wedding band (worth CA$8,700) and a 2015 Jeep Cherokee. She will also retain about CA$90,000 in cash, a CA$20,000 Registered Retirement Savings Plan and her shares of the company. She will have to vacate her home in Fall River, N.S., by the end of the month.

November 18, 2019 — Einstein, another cryptocurrency exchange in Canada, goes belly up. The news comes out that there’s nothing left at all. The money and cryptos are all gone. The British Columbia Securities Commission had been investigating Einstein since May 2019 — after multiple complaints from customers who couldn’t access their funds, going back to January 2018, David Gerard reports in his blog.

December 13, 2019 — Law firm Miller Thomson sends a letter to the Royal Canadian Mounted Police on behalf of Quadriga creditors requesting the RCMP exhume Cotten’s body and perform a post-mortem autopsy to confirm his “identity and the cause of death.” Of course, they want this done before spring when the warmer weather is sure to cause the body to further decompose.

January 8, 2020 — Argo Partners, a New York City hedge fund that specializes in purchasing bad debt against bankrupt entities, begins reaching out to Quadriga creditors to see who might interested in selling stakes in their remaining funds. An announcement (archive) on the firm’s website says that anyone interested in “receiving a price quote for your claim” should fill out an online form or call the firm directly.

January 22, 2020 — Miller Thomson, the representative counsel for QuadrigaCX creditors, asks creditors for help in identifying any records related to Crypto Capital Corp. In a letter (archive) posted on its website, the law firm said that it had received information that a “Panamanian shadow bank” may have been a payment processor for the exchange in the final quarter of its operation. In other words, Q4 2019.

Crypto Capital at one time listed Quadriga on its website as a client. The exchange’s now-deceased founder also admitted to using the firm in the past. In an email to Bloomberg News on May 17, 2018, Gerald Cotten wrote: “Crypto Capital is one such company that we have/do use. In general it works well, though there are occasionally hiccups.”

I found evidence strongly suggesting that financial documents from Quadriga’s former users do, in fact, link to Crypto Capital.

January 22, 2020 — EY’s 5th trustee report reveals the accounting firm racked up nearly $500,000 USD in costs responding to law enforcement requests in the second half of 2019.

January 28, 2020 — Miller Thomson gets fed up with the RCMP’s inaction, so it sends a letter to Bill Blair, Canada’s Minister of Public Safety and Emergency Preparedness, who is the person responsible for the RCMP. Will Cotten’s body will be exhumed by springtime, or not? That is the question.

June 1, 2020 — All virtual currency exchanges in Canada as well as foreign virtual currency exchanges serving Canadian residents are now required to register as a money services business with the country’s anti-money-laundering watchdog FinTRAC.

June 11, 2020 — The Ontario Securities Commission publishes its review of QuadrigaCX. Gerald Cotten operated Quadriga like Ponzi scheme, the OSC said. “What happened at Quadriga was an old-fashioned fraud wrapped in modern technology.”

# # #

POSConnect, a third-party payment processor holding funds on behalf of failed Vancouver-based crypto exchange QuadrigaCX, has come up with more excuses to delay handing over the money.

POSConnect, a third-party payment processor holding funds on behalf of failed Vancouver-based crypto exchange QuadrigaCX, has come up with more excuses to delay handing over the money.

The the U.S. Securities and Exchange Commission issued a “

The the U.S. Securities and Exchange Commission issued a “ Quadriga had no company bank accounts. Instead, it relied on a patchwork of third-party payment processors. As a Quadriga customer, you would send cash to one of these payment processors, and Quadriga would credit your account with Quad Bucks, which you could then use to buy crypto on the platform. When you put in a request to withdraw fiat from the exchange, a payment processor would wire you money.

Quadriga had no company bank accounts. Instead, it relied on a patchwork of third-party payment processors. As a Quadriga customer, you would send cash to one of these payment processors, and Quadriga would credit your account with Quad Bucks, which you could then use to buy crypto on the platform. When you put in a request to withdraw fiat from the exchange, a payment processor would wire you money.

ShapeShift

ShapeShift

You recall my story on

You recall my story on  Stewart McKelvey

Stewart McKelvey Kraken’s CEO Jesse Powell has done two

Kraken’s CEO Jesse Powell has done two  Quadriga was granted a 45-day stay from its creditor protection deadline, and the judge gave a thumbs up, albeit reluctantly, to the appointment of a chief restructuring officer (CRO).

Quadriga was granted a 45-day stay from its creditor protection deadline, and the judge gave a thumbs up, albeit reluctantly, to the appointment of a chief restructuring officer (CRO).  Ernst and Young (EY), the court-appointed monitor in Quadriga’s Companies’ Creditor Arrangement Act (CCAA), has filed its

Ernst and Young (EY), the court-appointed monitor in Quadriga’s Companies’ Creditor Arrangement Act (CCAA), has filed its

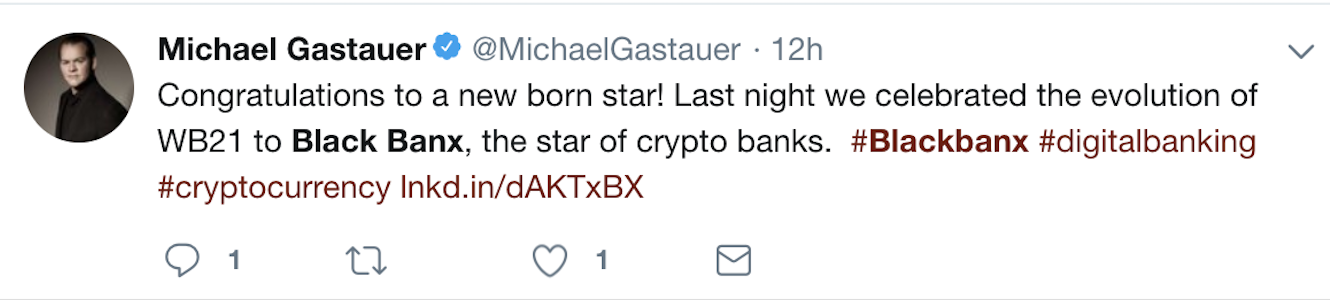

Gastauer, a man in his mid-40s who hails from Germany, also appears in an impressive Youtube

Gastauer, a man in his mid-40s who hails from Germany, also appears in an impressive Youtube  The 104 bitcoin (worth $468,675 CAD) that Canadian crypto exchange QuadrigaCX “inadvertently” sent to its dead CEO’s cold wallets on February 6—a day after the company filed for creditor protection—was due to a “platform setting error.”

The 104 bitcoin (worth $468,675 CAD) that Canadian crypto exchange QuadrigaCX “inadvertently” sent to its dead CEO’s cold wallets on February 6—a day after the company filed for creditor protection—was due to a “platform setting error.” QuadrigaCX creditors now have a legal team to represent them in the crypto exchange’s

QuadrigaCX creditors now have a legal team to represent them in the crypto exchange’s  Did you know that if you wanted to cash out of Quadriga, you could opt to hav

Did you know that if you wanted to cash out of Quadriga, you could opt to hav April 5, 2017

April 5, 2017

January 22, 2019 — Robertson sends a

January 22, 2019 — Robertson sends a  February 28, 2019 —

February 28, 2019 —