In January 2019, QuadrigaCX, the largest cryptocurrency exchange in Canada, went belly up after its founder, Gerald Cotten, died under bizarre circumstances in India. Roughly $200 million (Canadian) in customer funds disappeared along with him.

Investigations revealed that Cotten had been running Quadriga like a Ponzi, treating customer deposits like his own personal slush fund. The timing of his death was peculiar, as the clock was ticking on his Ponzi. Cotten was struggling to keep up with customer withdrawals. Instead of getting caught and going to jail, he died and went to heaven. Although some still think he faked his demise.

Six months prior to his death, Cotten wed Jennifer Robertson, a woman he met four years earlier. Weeks before he died, he signed a detailed will leaving everything to her. When Quadriga’s customers realized they had been duped, they had questions — lots of questions — and some of those question were directed at Robertson, the person closest to Cotten when he passed.

During Quadriga’s bankruptcy hearings, Robertson refused interviews with the press. Little was known about her. Now she has a book: “Bitcoin Widow: Love, Betrayal and the Missing Millions.” The 330-page memoir comes out Jan. 18 and is available on Amazon (US, Canada, UK). HarperCollins Canada is the publisher.

Robertson did not pen the memoir alone. Instead, she enlisted the help of Canadian journalist Stephen Kimber. Here he is a year ago talking about the project. Kimber actually did a pretty good job piecing all of this together, but despite his professionalism, the book is still a slog. I don’t recommend it.

Robertson lacks the depth and introspection you might expect from someone who was “betrayed.” She also lacks empathy. The book is mostly about her feeling wronged by the press—e.g. me. She treats the 76,000 Quadriga customers who Cotten hurt only as an afterthought.

Here is what she wants us to believe: She wants us to believe that Cotten is really dead. (Jilted investors at one point wanted his body exhumed to prove this wasn’t a massive exit scam.) She wants us to believe she truly loved Cotton, who she describes as her “soul mate.” She also wants us to believe she had no inkling of the massive fraud that her partner was committing — and that she was benefiting from.

“The possibility that Gerry had committed fraud never even crossed my mind,” she writes.

The book contains mostly what we already know from court documents and investigations. It also includes details most readers could probably care less about, such as she lost her virginity in tenth grade, her mother worked at a post office, and she is obsessed with the number eight. Coincidentally, the first chapter opens on December 8, 2018.

On that day, Robertson and Cotten are on their honeymoon in Jaipur, India. After they check into the opulent Oberoi Rajvilas hotel for $800 (Canadian) a night, Cotten, age 30, who was diagnosed with Crohn’s before the pair met, has come down with a horrendous bellyache.

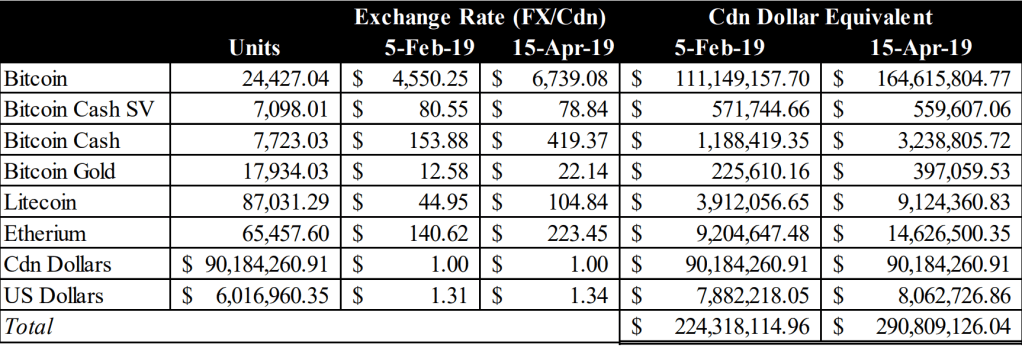

All told, 2018 was the year Quadriga started losing its wheels. In January, the Canadian Imperial Bank of Commerce (CIBC) froze $30 million (Canadian) in Quadriga funds. On top of that, as the price of bitcoin plummeted, more and more people were exiting their positions and trying to get their cash off of the exchange. Little did they know, hardly any cash, or any crypto, was left.

Robertson gets Cotten into the upscale Fortis hospital where his condition worsens. The following day, he goes into cardiac twice times. Doctors revive him. When he goes into cardiac arrest a third time, he dies. She is with him throughout the entire event and is tasked with getting his body back to Halifax, where they were living before things fell apart. A closed-casket funeral is held and Cotten’s body is put into the frozen earth. His body was severely swollen, too swollen for public viewing, Robertson says.

The book jumps back and forth in time as Robertson relives the trauma of losing the alleged love of her life. I have to admit, it is difficult picturing Cotten as a catch outside of all of his money, as charming as many people said he was. Looking at the Youtube videos he posted, he appears immature. Here he is holding his brother Brad upside-down in 2012. “Have you ever tried drinking water upside down?” Brad says, the two of them in fits of giggles. This is the man child Robertson fell in love with.

Anyway, as Robertson recounts her life, she takes us through her on-again-off-again relationship with Jacob Forgeron, who she met in 10th grade and later married. The marriage ends in divorce, and soon after, she meets Cotten on Tinder, a popular dating app. They are both 26.

Cotten founded Quadriga in late 2013 with business partner Michael Patryn, who turns out to be ex-con Omar Dhanani, who spent 18 months behind bars in the US, before being sent back to Canada. Robertson claims she never actually met Patryn and had no notion of his shady past — or that Cotten and Patryn went way back.

“Even though they were business partners at Quadriga, for instance, I never met Michael Patryn face to face, or anyone else connected to the company that was at the centre of Gerry’s work life,” she writes.

The entire book is like this — Robertson presenting shocking facts about Cotten and Quadriga and her putting a spit and shine on it to polish up her reputation. Essentially, she denies knowing anything about the inner workings of the business. The book title should have been: “I Know Nothing!”

Cotten and Robertson lived together starting in May 2015. They already had their pet name, calling each other “Booboo.” Up until that time, she made her living mainly as a bartender and waiting tables. She worked full-time in human resources for Porter Airlines but quit when she met Cotten, returning to waitressing and bartending on the side.

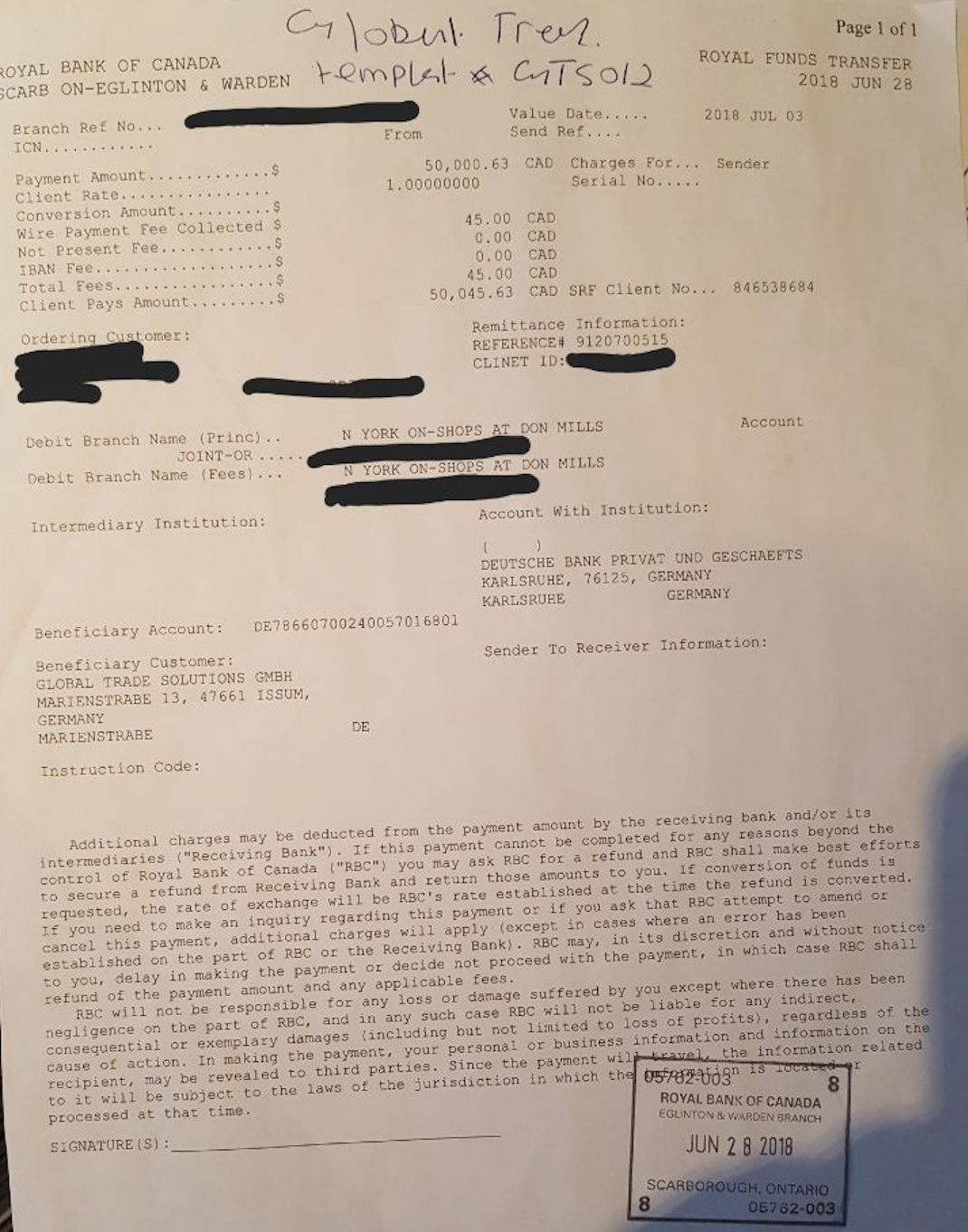

Quadriga could not get banking — banks don’t like dealing with crypto companies due to the high risk of money laundering. To get around that, Robertson describes how Cotten hired freelancers and had them set up bank accounts, so they could process funds on behalf of Quadriga.

She herself set up Robertson Consulting Nova to process money for Cotten. “Gerry would deposit money destined for clients into my corporate account and then send me lists of their names and email addresses and the amount I was to send each of them. I’d either send the funds by wire or e-transfer.”

Robertson earned an extra $1,000 (Canadian) a month this way — but oddly, it didn’t seem to trigger any alarm bells for her. She stopped processing payments, she said, after they moved from Toronto to Halifax, where they bought their first home together in 2016.

By then Quadriga was using “commercial payment processors” — her term for shadow banks that basically set up a network of bank accounts to funnel money to and from Quadriga customers. She said she knew nothing of Quadriga’s clients beyond what she needed to know to send them money.

Cash is another way to get around banks and Cotten dealt with lots of it. “Gerry continued to deal in cash over all the time we were together, but the piles grew bigger and bigger,” Robertson said. Cotten was doing business with Adam O’Brien who ran a Bitcoin ATM company in Canada. Cotten supplied O’Brien with crypto, and O’Brien, in turn, brought Cotten suitcases full of bills from the sale of bitcoin — $20 million (Canadian) in total, enough to raise most people’s eyebrows, but not Robertson’s.

“I understood from Gerry that cryptocurrency was still new, so old-school, conventional bankers were often suspicious of it. That was one reason why Gerry said he worked so hard to verify the bona fides of his customers,” she wrote.

The bona fides of his customers? Bitcoin ATMs are essentially nothing more than street-corner money laundering machines. They charge high transaction fees, which criminals don’t mind paying for the simple reason that bitcoin ATMs generally don’t require identity checks up to certain amounts, particularly in Canada, up until recently.

When Robertson was searching for new employment, Gerry suggested they take up their newfound wealth and invest in real estate. Robertson set up Robertson Nova, her residential property management company (not to be confused with her payment processing business), and started buying up real estate. Eventually, the pair owned 16 rental properties to the tune of $7.5 million (Canadian). Robertson brought in her stepfather Tom Beazley to help manage the properties and got herself a personal assistant named Tanya Reid, who would drink beer with her and listen to her woes when needed.

Beazley and Reid were doing most of the heavy lifting for Robertson’s company — which she called a “financial success.” Reid also became the couple’s errand girl. “In the end, Tanya became a primary personal assistant for Gerry, picking up laundry and running errands, while Gerry continued to run the business as he always had — alone, from inside his laptop,” Robertson wrote in her book.

She tells us she didn’t care about the money. However, she clearly didn’t mind spending it either. The book details countless vacations she took with Cotten — a cruise around South America, a wedding celebration in a castle in Scotland for the extended family, a mini-honeymoon in Amsterdam, another cruise around the Baltic Sea, another one to the Galapagos, and so on. The couple bought a yacht, a small island, a vacation home, and even chartered a private plane. The entire relationship was one big vacation.

It’s a wonder that Cotten, who ran Quadriga as a one-man show from his laptop after 2016 when Patryn supposedly stepped away, got any real work done at all. Actually, we now know he wasn’t actually working so much as spending and gambling away other people’s money.

It is also a wonder that Robertson, who talks at length about her curiosity for the world, had no curiosity whatsoever about Cotten’s business or the piles of cash coming in and going out of their home. At one point, she describes delivering “multiple thousands of dollars of cash” to Cotten, so that he could mail the money to his customers.

After Cotten died, Robertson’s fantasy world came apart at the seams, and she was hounded by journalists. She was shocked and offended by the innuendo and suspicions. I’m the only journalist she specifically calls out in the book by name: “Amy Castor, a freelance journalist, who ‘focuses on cryptocurrencies and financial fraud,’ would later add more fuel to this fire when she described me as ‘moving aggressively to protect her newly acquired assets.’”

That statement was absolutely true, by the way. Even before the accountants, judges, and lawyers moved in to clean up the mess that was Quadriga, Robertson was moving property into her own name to protect it from creditors. In the end, she had to hand over nearly everything to Ernst and Young, the court-appointed monitor and bankruptcy trustee. Initially, she proposed to keep $5 million (Canadian) — money that never would have ended up in her name had Cotten not stolen millions from his customers.

She also wanted to keep her engagement band, worth $80,000 (Canadian). Here is her reasoning for finally opting to give it up without a fight: “In practical terms, selling it would put the smallest of dents in the huge losses [Quadriga investors] already suffered. But symbolically, taking that ring off my finger offered a small measure of vengeance for all that Gerry had done to harm them.”

What Robertson doesn’t seem to understand is that none of that money was hers, to begin with. In the end, she was allowed to keep her wedding band, $90,000 (Canadian) in cash, her $20,000 (Canadian) retirement fund, her Jeep Cherokee, and some other personal belongings.

She mourned dead Gerry by writing to him: “Oh, sweetheart, I only now understand just how much stress you were under . . . I am so sorry. This must have been awful for you.”

It’s a shame she never wrote any such heartfelt letters to Quadriga customers. One of them even lost his entire life savings. Did she understand how much stress he was under?

At one point, during the court proceedings that followed Quadriga’s shuttering, Robertson went to Aruba to escape the pressure and tried to commit suicide by swallowing too many Ativan. She managed to save herself by calling an ambulance. This is the first I’ve heard of her suicide attempt.

Robertson is now moving on with her life. She moved into a cabin owned by her family, taught English online for a bit, and went back to school. She had two relationships after Cotten, and neither of them ended well because she “still had feelings for Gerry.” I’ve heard from a source that she is now in yet another relationship and is heavily pregnant. Cotten has been dead for three years now.

If you have been following the Quadriga saga, you won’t find much new in “Bitcoin Widow.” Robertson is a hard person to feel sympathy for. She is getting on with her life, sure, but there are still 76,000 Quadriga customers waiting for the bankruptcy courts to return a fraction of their losses. They are struggling to get on with their lives too.

After chatting with David Gerard online, what we both can’t seem to figure out is why Robertson wrote this book, to begin with. She is not being sued, the money is long gone, and all of this is old news. David posted his own review of the book here.

March 9, 2022: This article has been updated to correct a few inaccuracies noted by Jennifer Roberton. Cotten went into cardiac arrest three times, not two times. Cotten and Robertson took a cruise around South America, not South Africa. Also, they never took a cruise to Australia. They booked a cruise to Australia but never made it because Cotten died in India. Robertson wants us to know that she did not work “mainly” as a bartender and waitress. She was an “HR professional.” (While it is true she had a few HR jobs, she was always happy to leave those jobs when the opportunity for travel and leisure presented itself. She quit her full-time post in the HR department of Porter Airlines when she met Cotten, saying in the book, she returned to bartending and waitressing on the side.) Finally, Robertson did not at one time deliver cash directly to Quadriga customers, as I misstated earlier. She delivered cash to Cotten, who then mailed it to Quadriga customers.

If you like my work, please consider supporting my writing by subscribing to my Patreon account for as little as $5 a month.

As if Reggie Flower did not have enough trouble on his hands. After

As if Reggie Flower did not have enough trouble on his hands. After

FCoin, a crypto exchange based in Singapore,

FCoin, a crypto exchange based in Singapore,

Vodafone dealt another blow to the Libra project, when it announced on Tuesday it had

Vodafone dealt another blow to the Libra project, when it announced on Tuesday it had  Recently, I visited a Bitcoin ATM in Los Angeles and spent time chatting with the owner of the machine. He told me that his machine charged a 7% transaction fee for bitcoin purchases—5% if you are selling bitcoin—and they only do ID checks for amounts over $280.

Recently, I visited a Bitcoin ATM in Los Angeles and spent time chatting with the owner of the machine. He told me that his machine charged a 7% transaction fee for bitcoin purchases—5% if you are selling bitcoin—and they only do ID checks for amounts over $280.

I just had my

I just had my  Ernst & Young (EY) has issued a

Ernst & Young (EY) has issued a  Bitfinex has a $851 million shortfall due to issues with Crypto Capital. How is it going to fix that? Here is an idea: Why not just print more money?

Bitfinex has a $851 million shortfall due to issues with Crypto Capital. How is it going to fix that? Here is an idea: Why not just print more money? POSConnect, a third-party payment processor holding funds on behalf of failed Vancouver-based crypto exchange QuadrigaCX, has come up with more excuses to delay handing over the money.

POSConnect, a third-party payment processor holding funds on behalf of failed Vancouver-based crypto exchange QuadrigaCX, has come up with more excuses to delay handing over the money.

The the U.S. Securities and Exchange Commission issued a “

The the U.S. Securities and Exchange Commission issued a “ Quadriga had no company bank accounts. Instead, it relied on a patchwork of third-party payment processors. As a Quadriga customer, you would send cash to one of these payment processors, and Quadriga would credit your account with Quad Bucks, which you could then use to buy crypto on the platform. When you put in a request to withdraw fiat from the exchange, a payment processor would wire you money.

Quadriga had no company bank accounts. Instead, it relied on a patchwork of third-party payment processors. As a Quadriga customer, you would send cash to one of these payment processors, and Quadriga would credit your account with Quad Bucks, which you could then use to buy crypto on the platform. When you put in a request to withdraw fiat from the exchange, a payment processor would wire you money.  ShapeShift

ShapeShift

Stewart McKelvey

Stewart McKelvey Kraken’s CEO Jesse Powell has done two

Kraken’s CEO Jesse Powell has done two  Ernst and Young (EY), the court-appointed monitor in Quadriga’s Companies’ Creditor Arrangement Act (CCAA), has filed its

Ernst and Young (EY), the court-appointed monitor in Quadriga’s Companies’ Creditor Arrangement Act (CCAA), has filed its