Bitcoin broke $16,000 on Thursday. That’s up from $10,000 in early September. And yet, with all the media outlets rabidly covering the latest “Bitcoin bull run,” the only one mentioning the billions and billions of dollars worth of tether (USDT) entering the market was Cointelegraph.

In particular, none of the mainstream press has bothered to mention tether in their writings about BTC’s recent price rise. This is worrisome because retail folks — the ones most vulnerable to risky investments — have little understanding of tether and the risk it imposes on Bitcoin’s price.

Instead, most media pointed to the election, PayPal’s recent embrace of crypto and huge BTC investments by MicroStrategy and Square as the reasons for BTC’s moon. Mainstream adoption! Institutional money! The truth is, crypto markets are easy to manipulate. And when BTC goes up in value like this, the main benefit is so early investors can cash out.

In other words, BTC gets passed on to the next bright-eyed, bushy-tailed dupe who hopes the price will continue skyward. History has shown, however, these bubbles are generally followed by a crash, and a lot of people getting hurt, which is exactly what happened in 2018.

Trolly McTrollface (not his real name, obvs) points out in a tweet thread that Tether went into hyperdrive in March to stop BTC from crashing. BTC had dropped to $5,000, losing half its value from two months prior. In fact, March is when BTC entered its current bull run phase.

Remember, if the price of BTC falls too low, the network’s miners — who are responsible for Bitcoin’s security — can’t make a profit, and that puts the entire network in danger.

Trolly believes the current price pump is a coordinated effort between Tether — which has now issued a jaw-dropping $18 billion worth of dollar-pegged tethers — and the exchanges.

Let’s talk about some of those exchanges.

OKEx withdrawals still frozen

Withdrawals from OKEx, one of the biggest crypto exchanges, have been frozen ever since the news came out that founder “Star” Xu was hauled away for questioning by Shanghai authorities more than a month ago.

Xu’s interrogation appears to be part of a broader crackdown on money laundering in China, though OKEx denies any AML violations.

OKEx is registered in Malta, but retains offices in Shanghai and Beijing, where it facilitates peer-to-peer—or “over-the-counter”—trades. The exchange acts as an escrow to reduce counter-party risk in fiat-to-crypto trades, so you don’t have to worry about someone disappearing with your cash before they hand over the BTC you just bought from them.

As Wolfie Zhao explains for the Block, these OTC trades are the only fiat on/off ramp for Chinese crypto traders—and have been ever since September 2017 when the country banned crypto trading on exchanges.

Effectively, the government made it so the exchanges could no longer get access to banking in the country.

P2P allows two people to transact directly, thus bypassing the Chinese ban, as long as the trades are small in scale. All Chinese crypto-to-fiat is OTC, while crypto-to-crypto trades are still done via a matching order book. (A Chinese citizen simply needs to use a VPN to access Binance, for instance.)

Currently, the OTC desk is the only trading desk that remains open at OKEx All of its exchange trading activity has been ground to a halt. The exchange claims Xu has access to the private keys needed to access its funds, and until he is free, all that crypto sits locked in a virtual vault.

As a result, according to blockchain analytics firm Glassnode, there are currently 200,000 bitcoin stuck on OKEx. The exchange insists all funds are safe, and says, essentially, that everything will be fine as soon as Xu returns. But its customers remain anxious. Did I mention OKEx is a tether exchange?

Huobi, another exchange in peril?

Like OKEx, Huobi is another exchange that moved its main offices out of China following the country’s 2017 crackdown on crypto exchanges.

Huobi, now based in Singapore, continues to facilitate fiat-to-bitcoin and fiat-to-tether trades in China behind an OTC front. (Dovey Wan does a nice job explaining how this works in her August 2019 story for Coindesk.)

Since earlier this month, rumors have circulated that Robin Zhu, Huobi’s chief operating officer, was also dragged in for questioning by Chinese authorities. Huobi denies the rumors.

Meanwhile, since Nov. 2—the day Zhu was said to have gone missing —$300 million worth of BTC has flowed from Huobi to Binance, according to a report in Coindesk. (I still don’t have a good explanation as to why Huobi is doing this. If anyone can fill in the gaps, please DM me on Twitter.)

What’s up with Binance?

If you follow Whale Alert on Twitter, like I do, it’s hard to ignore the enormous influx of tether going into Binance multiple times a day.

Here’s an example: On Friday, in four separate transactions, Tether sent Binance a total of $101 million worth of tethers. The day prior to that, Tether sent Binance $118 million in tethers, and the exchange also received $90 million worth of tethers from an unknown wallet. And on Wednesday, Tether sent Binance $104 million in tethers.

That’s over $400 million worth of dubiously backed tethers—in three days.

Like Huobi and OKEx, Binance also has roots in China. And it has an OTC desk to facilitate fiat-to-crypto trades. Is it a coincidence that the top tether exchanges originate from China? And that China controls two-thirds of Bitcoin’s hash rate?

Reggie Fowler’s lawyers wanna quit

Reggie Fowler, the Arizona businessman in the midst of the Crypto Capital scandal, is running low on cash. His lawyers have decided they don’t do pro bono work, so now they want to drop him as a client.

Last month, Fowler’s legal team asked the court to change his bond conditions to free up credit. But apparently, that isn’t working. Unfortunately, all this is happening just when there was a possibility of negotiating another plea deal. (Read my blog posts here and here.)

Quadriga Trustee releases report #7

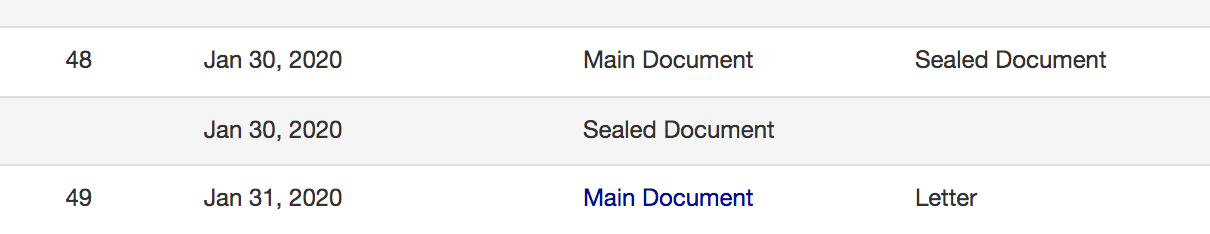

EY, the trustee handling the bankruptcy for failed Canadian crypto exchange QuadrigaCX, released its 7th Report of the Monitor on Nov. 5.

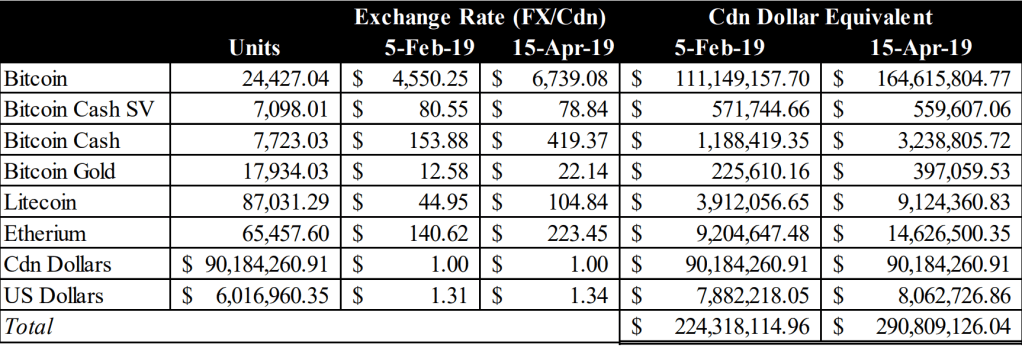

According to the report, EY has received 17,053 claims totaling somewhere between CA$224 million and CA$290 million—depending on what exchange rate EY ends up using to convert the USD and crypto claims to Canadian dollars for disbursement.

EY has CA$39 million ready to distribute to affected Quadriga users, who submitted claims. But none of that money is going anywhere until the Canadian Revenue Agency finishes its audit of the exchange. (Ready my blog post for more details.)

Gensler goes to Washington

Gary Gensler has been picked to lead President-elect Joe Biden’s financial reform transition team. As Foreign Policy notes, Gensler, who was the head of the CFTC during the Obama years, is an aggressive regulator.

He is also well familiar with the world of crypto. He taught a course on blockchain at MIT Sloan. He suspects Ripple is a noncompliant security, and he told me in an interview for Decrypt that the SAFT construct—a once-popular idea for launching an initial coin offering—will not spare a token from securities laws. (He also thinks 99% of all ICOs are securities.)

Libra Shrugged author David Gerard said in a tweet that Gensler was excellent in the Libra hearing last July. Gensler also “helped clean up the 2008 financial crisis, he knows literally all the possible nonsense,” said Gerard.

Clearly, this is good news for bitcoin.

Nov. 15 — Before I said that OKEx offered the only fiat-to-crypto on/off ramp in China. That is inaccurate. P2P OTC exchanges *in general* are the only fiat on/off ramps for crypto traders in China and have been since Sept. 2017.

Nov. 16 — Previously, this story stated that Quadriga’s trustee has CA$30 million available to distribute to claimants. It’s been updated to correctly reflect that EY has CA$39 million (US$30 million) to distribute.

The bankruptcy trustee for failed Canadian cryptocurrency exchange QuadrigaCX is now free to hand over a trove of documents—including personal information of the exchange’s users—to the Canadian tax authority.

The bankruptcy trustee for failed Canadian cryptocurrency exchange QuadrigaCX is now free to hand over a trove of documents—including personal information of the exchange’s users—to the Canadian tax authority. One of the biggest fears of cryptocurrency traders is losing control of their personal information. And that fear has become a reality for QuadrigaCX former users.

One of the biggest fears of cryptocurrency traders is losing control of their personal information. And that fear has become a reality for QuadrigaCX former users.  Facebook’s Libra may issue multiple coins based on national currencies in addition to its original idea—a coin based on a basket of assets. If it does that, it’ll be just another PayPal, but on the Calibra wallet.

Facebook’s Libra may issue multiple coins based on national currencies in addition to its original idea—a coin based on a basket of assets. If it does that, it’ll be just another PayPal, but on the Calibra wallet. Reginald Fowler stood before a New York judge Thursday and pleaded not guilty to wire fraud. The new charge brought the total counts against him to five. An irked-looking judge agreed to move the trial date, originally set for next month, to Jan. 11. (

Reginald Fowler stood before a New York judge Thursday and pleaded not guilty to wire fraud. The new charge brought the total counts against him to five. An irked-looking judge agreed to move the trial date, originally set for next month, to Jan. 11. (

As if Reggie Flower did not have enough trouble on his hands. After

As if Reggie Flower did not have enough trouble on his hands. After

FCoin, a crypto exchange based in Singapore,

FCoin, a crypto exchange based in Singapore,  We’ve both come here to be interviewed for a documentary on failed Canadian crypto exchange QuadrigaCX. I initially met with filmmaker

We’ve both come here to be interviewed for a documentary on failed Canadian crypto exchange QuadrigaCX. I initially met with filmmaker  It’s been a tight schedule this weekend. After a long day of travel, this morning, we went to this cool loft in downtown Vancouver for the filming. I was on the hot seat first, followed by David. As it turns out, talking for two-hours is really exhausting, especially when you’ve had only a few hours of sleep.

It’s been a tight schedule this weekend. After a long day of travel, this morning, we went to this cool loft in downtown Vancouver for the filming. I was on the hot seat first, followed by David. As it turns out, talking for two-hours is really exhausting, especially when you’ve had only a few hours of sleep.  What sports league would that be? The indictment does not tell us. But Fowler invested

What sports league would that be? The indictment does not tell us. But Fowler invested

Joe Lubin’s organism (that’s what he used to call it, an “organism) looks to be running into more funding trouble, so it’s going to spin off its venture arm. The company will basically become two separate businesses, a software business and an investment business. In the process, it’s also cutting another 14% of its staff. This is after cutting 13% of its staff in December. (

Joe Lubin’s organism (that’s what he used to call it, an “organism) looks to be running into more funding trouble, so it’s going to spin off its venture arm. The company will basically become two separate businesses, a software business and an investment business. In the process, it’s also cutting another 14% of its staff. This is after cutting 13% of its staff in December. (

Miller Thomson, the law firm representing Quadriga’s 76,000 creditors, is ramping up pressure on the Royal Canadian Mounted Police to dig up the body of Gerald Cotten, the deceased founder of the failed Canadian cryptocurrency exchange.

Miller Thomson, the law firm representing Quadriga’s 76,000 creditors, is ramping up pressure on the Royal Canadian Mounted Police to dig up the body of Gerald Cotten, the deceased founder of the failed Canadian cryptocurrency exchange. It was a bad smash. Early in the morning, after only a few hours sleep and a grueling yoga class, I stopped at a dog park. My dogs dashed out of the car, and as I was watching them, worried about coyotes, other dogs and cars in the vicinity (predators loom large in a tired mind), I wasn’t watching the finger, so I closed the door on it. My finger was so stuck in there, I had to actually pry open the door to get it out.

It was a bad smash. Early in the morning, after only a few hours sleep and a grueling yoga class, I stopped at a dog park. My dogs dashed out of the car, and as I was watching them, worried about coyotes, other dogs and cars in the vicinity (predators loom large in a tired mind), I wasn’t watching the finger, so I closed the door on it. My finger was so stuck in there, I had to actually pry open the door to get it out.  That said, I am very happy to be working for Modern Consensus. It is a small team, but a small team of very experienced and dedicated journalists, who know their stuff. And if it weren’t for the talented

That said, I am very happy to be working for Modern Consensus. It is a small team, but a small team of very experienced and dedicated journalists, who know their stuff. And if it weren’t for the talented  Vodafone dealt another blow to the Libra project, when it announced on Tuesday it had

Vodafone dealt another blow to the Libra project, when it announced on Tuesday it had  Last week, after a denial of bail, it looked like Virgil Griffith, the Ethereum Foundation developer who was

Last week, after a denial of bail, it looked like Virgil Griffith, the Ethereum Foundation developer who was  On top of the list — an ex-employee is suing Kraken, a prominent U.S. crypto exchange. (Here’s the

On top of the list — an ex-employee is suing Kraken, a prominent U.S. crypto exchange. (Here’s the