Ernst & Young (EY), the court-appointed monitor in Quadriga’s creditor protection procedures, filed its fourth monitor report with the Supreme Court of Nova Scotia on April 1.

In the latest twist in the ongoing Quadriga saga, EY is proposing Quadriga shift from its Companies’ Creditor Arrangement Act (CCAA) proceedings into proceedings under the Bankruptcy and Insolvency Act (BIA).

Bankruptcy offers key advantages. Namely, it would remove the need for several professionals, leaving more money to repay Quadriga’s 115,000 creditors. According to court docs, $250 million CAD ($190 million USD) in crypto and fiat were on the exchange when it collapsed, but likely only a fraction of that will be found.

In a bankruptcy, EY would become a trustee. That means Quadriga’s newly appointed chief restructuring officer (CRO) would no longer be needed. Company directors, Jennifer Robertson (the widow of Quadriga’s dead CEO Gerald Cotten) and her stepfather Tom Beazley, would also step out of the picture. (Robertson has already indicated, she doesn’t want to continue serving as a director anyway, which is why she opted for a CRO.)

Quadriga also won’t be needing a representative counsel. Last month, Stewart McKelvey, stepped down from the CCAA proceedings over a potential conflict of interest. The firm was representing both Quadriga in its CCAA proceedings and handling Cotten’s estate. Quadriga has not hired a replacement—and it won’t need to for a bankruptcy.

Cox & Palmer and Miller Thomson LLP, the legal team representing Quadriga’s affected users, would stay on. The recently formed seven-person committee that serves as the voice for Quadriga’s creditors, would also continue with their work.

But here is where things get interesting—as trustee, EY would be given additional investigatory powers without further relief from the court that will be of assistance in investigating the business and affairs of Quadriga, “including the right to compel production of documents and seek examination of relevant parties under oath.”

Finally, bankruptcy would allow for the potential sale of Quadriga’s operating platform.

Preserving Robertson’s assets

In late January, after Cotten’s death and before Quadriga filed for creditor protection, Robertson was moving aggressively to protect her newly acquired assets. She moved two properties into the Seaglass Trust, and Cotten’s airplane and yacht both went up for sale. EY has put a stop to any more of this by filing an “asset preservation order.”

During the course its investigations into Quadriga’s business and affairs, EY says it became aware of occurrences where the corporate and personal boundaries between Quadriga and Cotten were not formally maintained. EY notes that it appeared “Quadriga funds may have been used to acquire assets held outside the corporate entity.”

The asset protection order involves all assets held by the Cotten Estate, Robertson and the Seaglass Trust, and Robertson Nova Property Management—the company that Robertson purchased several properties under between 2016 and 2018. The order will allow EY’s investigation of Quadriga to continue “without concern that assets possibly recoverable for the applicant’s stakeholders may be dissipated,” the report said.

Likely Robertson is agreeing to the plan because, according to the report, EY “temporarily discontinued its preparation for a mareva injunction pending the negotiation and agreement of the draft Asset Preservation Order.”

A mareva injunction would have completely frozen all of the assets. Under an asset preservation order, Robertson is able to maintain control of her properties. She just can’t sell or transfer them. She has agreed to provide a list of relevant assets to EY. And she will be working with EY on monetizing some of the assets to preserve their value.

Wrestling with third-party payment processors

Quadriga had no company bank accounts. Instead, it relied on a patchwork of third-party payment processors. As a Quadriga customer, you would send cash to one of these payment processors, and Quadriga would credit your account with Quad Bucks, which you could then use to buy crypto on the platform. When you put in a request to withdraw fiat from the exchange, a payment processor would wire you money.

Quadriga had no company bank accounts. Instead, it relied on a patchwork of third-party payment processors. As a Quadriga customer, you would send cash to one of these payment processors, and Quadriga would credit your account with Quad Bucks, which you could then use to buy crypto on the platform. When you put in a request to withdraw fiat from the exchange, a payment processor would wire you money.

After Quadriga ceased operating on January 28, several of these third-party payment processors were left holding money on behalf of Quadriga and its users. EY mentions the following payment processors in its fourth report:

The monitor has been wrestling to get funds from several of these companies, a few of which weren’t exactly at arm’s length from Quadriga. RNCI was operated by Robertson — who earlier told the court she was not involved Quadriga’s operations. Apparently Cotten used RNCI bank accounts to transfer money to Quadriga customers. Robertson is cooperating though. She says RNCI is currently not holding any Quadriga funds, and she is working to get bank statements of all transfers her company made to EY.

700964 N.B. Inc. and 1009926 B.C. Ltd. were both run by Quadriga contractors. 700964 N.B. was run by Aaron Matthews, Quadriga’s director of operations, and 1009926 B.C. was run by Aaron Vaithilingam, Quadriga’s former office manager.

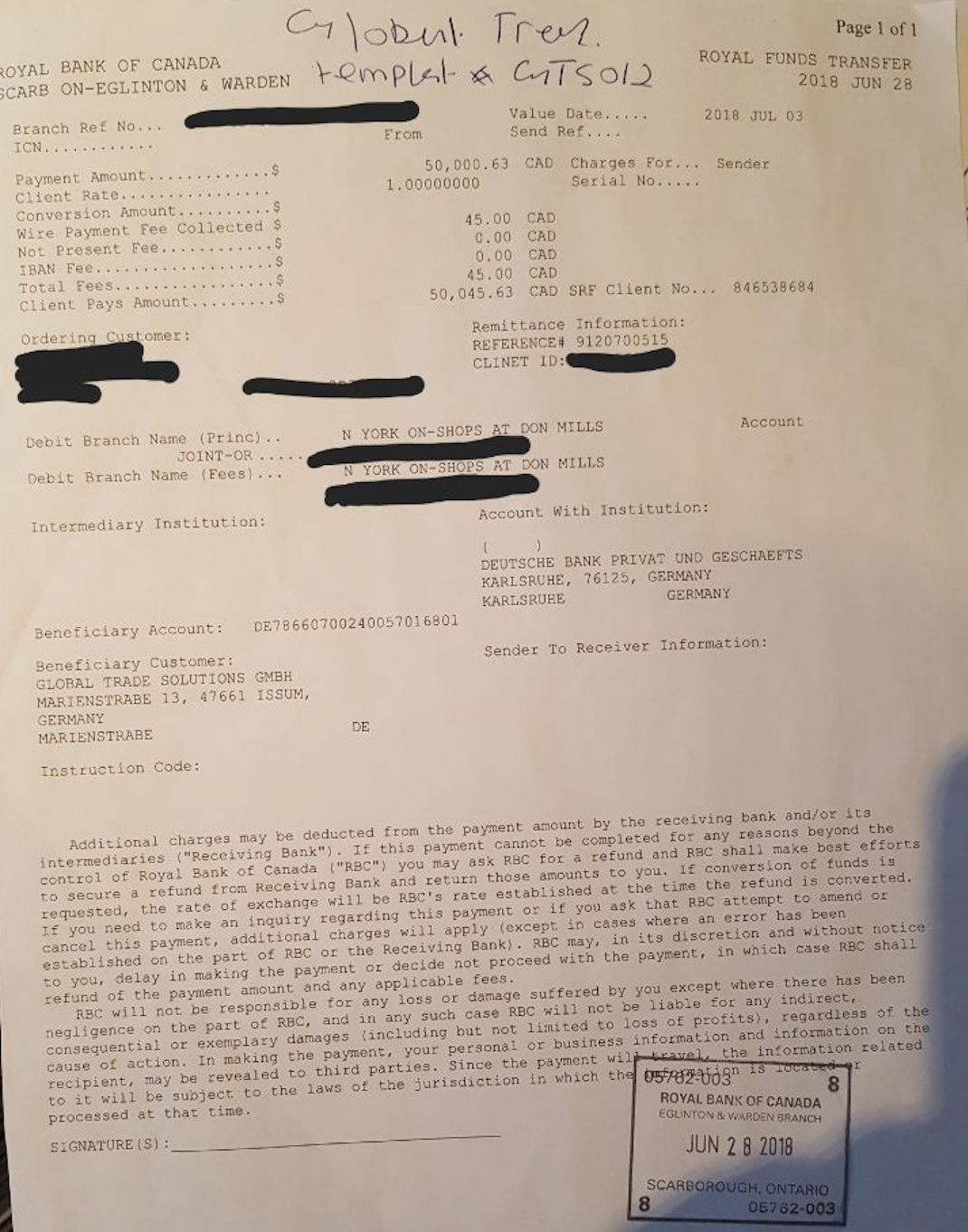

EY has in its possession 1,004 bank drafts, worth $5,824,340 CAD, written out to 1009926 B.C. It had trouble depositing those checks, because 1009926 B.C., the company, had dissolved. (This is yet another example of how sloppily Quadriga handled its affairs.) Now that 1009926 B.C. has been restored, Royal Bank of Canada (RBC) is asking for additional documents to deposit the bulk drafts. But Vaithilingam is not responding to EY’s letters.

EY has also reached out to WB21, the third-party payment processor holding on to roughly $9 million USD ($12 million CAD) in Quadriga funds. WB21 recently changed its name to Black Banx, and it has an office in Canada.

EY wrote to Michael Gastauer, the sole director of WB21, in February, requesting the company return any Quadriga funds to EY. WB21 responded by saying that Quadriga’s account was was closed in December 31, 2018, and it was entitled to withhold funds if there was “reasonable doubt that the end user has engaged in fraudulent activity.” On March 9, EY wrote again requesting copies of the agreements. WB21 wrote back saying it was only holding $11.77 CAD and $5.53 USD and that it “might be able to provide further information” upon conclusion of an internal investigation.

EY is not buying it, and you can bet it’s probably had enough of these shenanigans. The monitor is convinced WB21 is holding “a significant amount of funds.” The monitor also writes that WB21 has been uncooperative and has not provided “even basic info” and that it is inappropriate for WB21 to continue holding funds pending some investigation.

(Related story: “Diving into WB21—the company holding $9 million of Quadriga money“)

Here is another surprise—EY just discovered that Jose Reyes, who runs Billerfy and Costodian, operates yet another third-party processor, which has also received funds from Quadriga. Despite all the work Reyes has done with EY trying to sort out the $26 million in Bank of Montreal (BOM) drafts, he neglected to mention his other company ePAD also held Quadriga money. EY sent letters requesting account information, but so far, Reyes has not responded. (Read the interpleader order for more history on Reyes.)

EY also wrote to POSconnect who is supposedly holding $331,764 CAD in Quadriga funds. POSconnect followed up stating that it only owed $300,000, but that under the terms of its agreement with Quadriga, it would continue holding the funds until April 28. The monitor wrote again requesting immediate return of the funds.

VoPay is supposedly holding $217,000 CAD on behalf of Quadriga. In February, VoPay told Quadriga’s counsel that it was not in a position to return the funds, because it had gotten legal threats from Quadriga customers. VoPay confirmed it is holding $116,262 CAD for Quadriga and requested indemnity from EY, which EY says it can’t provide and again requested VoPay give back the money asap.

Alto Bureau de Change is a currency exchange shopfront in Montreal. Alto believed it had never done business with Quadriga, but EY noted a transfer from Quadriga to Alto of $160,000 CAD worth of bitcoins and $30,000 CAD processed on behalf of Quadriga by NB Inc. EY believes that Alto currently holds either $20,876 or $36,213 of Quadriga funds.

EY is seeking a court order to get several of the third-party payments processors to hand over funds and/or any documentation related to Quadriga.

The monitor’s research into Quadriga’s missing funds is winding down. It plans to file its final monitor report in a few weeks. Oddly, this report did not mention anything about recovery of the platform’s historical data on AWS—a big issue in the third report.

The next hearing is scheduled for April 8.

One of the biggest fears of cryptocurrency traders is losing control of their personal information. And that fear has become a reality for QuadrigaCX former users.

One of the biggest fears of cryptocurrency traders is losing control of their personal information. And that fear has become a reality for QuadrigaCX former users.

POSConnect, a third-party payment processor holding funds on behalf of failed Vancouver-based crypto exchange QuadrigaCX, has come up with more excuses to delay handing over the money.

POSConnect, a third-party payment processor holding funds on behalf of failed Vancouver-based crypto exchange QuadrigaCX, has come up with more excuses to delay handing over the money. Quadriga had no company bank accounts. Instead, it relied on a patchwork of third-party payment processors. As a Quadriga customer, you would send cash to one of these payment processors, and Quadriga would credit your account with Quad Bucks, which you could then use to buy crypto on the platform. When you put in a request to withdraw fiat from the exchange, a payment processor would wire you money.

Quadriga had no company bank accounts. Instead, it relied on a patchwork of third-party payment processors. As a Quadriga customer, you would send cash to one of these payment processors, and Quadriga would credit your account with Quad Bucks, which you could then use to buy crypto on the platform. When you put in a request to withdraw fiat from the exchange, a payment processor would wire you money.  You recall my story on

You recall my story on  Kraken’s CEO Jesse Powell has done two

Kraken’s CEO Jesse Powell has done two  Ernst and Young (EY), the court-appointed monitor in Quadriga’s Companies’ Creditor Arrangement Act (CCAA), has filed its

Ernst and Young (EY), the court-appointed monitor in Quadriga’s Companies’ Creditor Arrangement Act (CCAA), has filed its  The 104 bitcoin (worth $468,675 CAD) that Canadian crypto exchange QuadrigaCX “inadvertently” sent to its dead CEO’s cold wallets on February 6—a day after the company filed for creditor protection—was due to a “platform setting error.”

The 104 bitcoin (worth $468,675 CAD) that Canadian crypto exchange QuadrigaCX “inadvertently” sent to its dead CEO’s cold wallets on February 6—a day after the company filed for creditor protection—was due to a “platform setting error.”