- By Amy Castor and David Gerard

- Help our work: if you liked this post, tell just one other person. It really helps, especially since Twitter’s trash now.

- You can also send us money! Here’s Amy’s Patreon and here’s David’s. For casual tips, here’s Amy’s Ko-Fi and here’s David’s.

- David has signed author copies of his books for sale.

- We still have “Bitcoin: It Can’t Be That Stupid” stickers for patrons! Message one of us and ask!

- Sign up on Amy’s blog to see every new post she makes as it goes up, and click here and enter your email address for every new post on David’s blog as it goes up.

It’s not over until withdrawals are temporarily paused due to unusual market activity.

— Jacob Silverman

Tightening Tether’s tethers

Tether’s been under some regulatory heat after the reports of how useful USDT is for financing terrorists and other sanctioned entities. Even Cynthia Lummis, the crypto-pumping senator from Wyoming, loudly declared that Tether had to be dealt with.

The US government isn’t entirely happy with Tether’s financial shenanigans. But they’re really unhappy about sanctions violations, especially with what’s going on now in the Middle East.

So Tether has announced that it will now be freezing OFAC-sanctioned blockchain addresses — and it’s onboarded the US Secret Service and FBI onto Tether! [Tether, archive; letter, PDF, archive]

Tether doesn’t do anything voluntarily. We expect they were told that they would allow this or an extremely large hammer would come down upon them.

There’s more to Tether’s criminal use case than sanctions violation. The most jaw-dropping chapter in Zeke Faux’s excellent book Number Go Up (US, UK) is when he traced a direct message scammer to a human trafficking operation in Cambodia that favored tethers as its currency. South China Morning Post follows up on this with an in-depth report on how Cambodian organized crime uses tethers. [SCMP]

Credit rating firm S&P Global rated eight stablecoins for risk. Tether and Dai got the lowest marks. S&P notes in particular the lack of information on Tether’s reserves. [press release; S&P; Tether report, PDF]

At least some of the claimed Tether backing in treasuries is held in the US with Cantor Fitzgerald — exposing Tether to US touchability. This has been known since February 2023, and was proudly confirmed in December 2023 by Cantor CEO Howard Lutnick: “I hold their Treasuries, and they have a lot of Treasuries. I’m a big fan of Tethers.” [Ledger Insights; Forbes]

Cointelegraph had a fascinating story on a company called Exved using tethers for cross-border payments from Russia! Then they deleted it, for some reason. Exved was founded by Sergey Mendeleev, who also founded the OFAC-sanctioned crypto exchange Garantex, which was kicked out of Estonia. Exved is working with InDeFi Bank, another Mendeleev venture. We’re not so sure the new OFAC-compliant Tether will be 100% on board with this. [Cointelegraph, archive; Telegram, in Russian; Protos]

SEC answers Coinbase’s prayers: “No.”

In July 2022 — just after crypto crashed — Coinbase wrote to the SEC proposing new regulatory carveouts for crypto.

The SEC took its sweet time responding. Eventually, Coinbase sued in April 2023 with a writ of mandamus, demanding a bureaucratic response. The court told the SEC to get on with it, or at least supply a date by which it would answer.

Finally, the SEC has responded: “the Commission concludes that the requested rulemaking is currently unwarranted and denies the Petition.” The SEC thinks existing securities regulations cover crypto securities just fine, and there’s no reason for special rules for Coinbase. [SEC rejection, PDF; Coinbase letter to court, PDF; Gensler statement]

Coinbase general counsel Paul Grewal welcomed the opportunity to challenge Coinbase’s dumb and bad proposal being turned down. [Twitter, archive]

4 (continued)

Binance founder and former CEO Changpeng Zhao will not be returning home to Dubai anytime soon. US District Judge Richard Jones ordered CZ to remain in the US until his sentencing on February 24. He can travel within the US, but he cannot leave. [Order, PDF]

After being busted hard, Binance is still behaving weird. At the FT Crypto and Digital Assets Summit in London, the exchange’s new CEO Richard Teng refused to answer even basic questions, like where Binance is headquartered and whether it’s had an audit. “Why do you feel so entitled to those answers?” Teng said when pushed. “Is there a need for us to share all of this information publicly? No.” [FT]

CZ and Binance have been trying to dismiss the SEC charges against them. This is mostly loud table pounding, wherein Binance claims that what the SEC argued were securities are not really securities. [Doc 190, PDF, Doc 191, PDF]

France was the first country in Europe to grant Binance regulatory approval. State-endorsed blockchain courses for the unemployed and NFT diplomas helped push the country’s most vulnerable into crypto. Since the collapse of FTX and Binance’s $4.3 billion fine for money laundering, French President Emmanuel Macron’s relationship with CZ has fallen under scrutiny. [FT, archive]

London law firm Slateford helped to cover up Binance’s crimes and attempted to intimidate media outlet Disruption Banking from writing about Binance’s sloppy compliance hiring practices. (Disruption Banking told Slateford to get knotted and didn’t hear from them again.) [Disruption Banking]

Binance is finally removing all trading pairs against Great British pounds. [Binance, archive]

FTX: The IRS wants its money

FTX filed a reorganization plan in mid-December. The plan is 80 pages and the disclosure statement is 138 pages, but there’s a notable lack of detail on what happens next. None of the talk of starting a new exchange has made it into the current plan — this appears to just be a liquidation.

The plan treats crypto claims as their value in cash at the time of the bankruptcy filing on November 11, 2022, back when bitcoin was at $17,000 — less than half of what it is now.

Creditors will vote on the plan in 2024. The court must approve the plan before it is implemented. [Bloomberg, archive; Plan, PDF; Disclosure statement, PDF]

The IRS is demanding $24 billion in unpaid taxes from the corpse of FTX. John Jay Ray wants to know how the IRS came up with that ludicrous number — the exchange never earned anything near those amounts. The IRS originally wanted $44 billion, but brought the number down. Judge John Dorsey has told the IRS to show its working. [Doc 4588, PDF; Bloomberg, paywalled]

Three Arrows Capital

Three Arrows Capital was the overleveraged crypto hedge fund that blew up in 2022 and took out everyone else in crypto who hadn’t already been wrecked by Terra-Luna. After months of dodging culpability, co-founder Zhu Su was finally arrested in Singapore in September as he was trying to skip the country.

Zhu was released from jail and appeared before the Singapore High Court on December 13, where he had to explain to lawyers for the liquidator Teneo what happened when 3AC went broke. The information will be shared with creditors. [Bloomberg, archive]

A British Virgin Islands court froze $1.1 billion in assets of Zhu and his co-founder Kyle Davies and Davies’ wife Kelly Chen. [The Block]

Teneo expects a 46% recovery rate for 3AC creditors on $2.7 billion in claims. [The Block]

Crypto media in the new Ice Age

Crypto news outlet Decrypt has merged with “decentralized media firm” Rug Radio. No, we’d never heard of them either. The two firms will form a new holding company chaired by Josh Quittner. Decrypt had spun out from Consensys in May 2022, just before everything crashed. It’s reportedly been profitable since then — though crypto sites always say that. [Axios; Axios, 2022]

Forkast News in Hong Kong has merged with NFT data provider CryptoSlam and fired most of its staff. Forkast was founded in 2018 by former Bloomberg News anchor Angie Lau; it shut down editorial operations on November 30. [The Block]

Crypto news outlets ran seriously low on cash in 2019 and 2020, just before the crypto bubble, and they’re struggling again. We expect more merges and buyouts of top-tier (such as that is in crypto) and mid-tier crypto outlets. We predict news quality will decline further.

Amy recalls the old-style crypto media gravy train and eating in five-star restaurants every night in Scotland and London while embedded with Cardano in 2017. Thanks, Charles! Nocoining doesn’t pay nearly as well, but these days crypto media doesn’t either. There’s probably a book in those Cardano stories that nobody would ever read.

Regulatory clarity

The Financial Stability Oversight Council, which monitors domestic and international regulatory proposals, wants more US legislation to control crypto. FSOC’s 2023 annual report warns of dangers from:

crypto-asset price volatility, the market’s high use of leverage, the level of interconnectedness within the industry, operational risks, and the risk of runs on crypto-asset platforms and stablecoins. Vulnerabilities may also arise from token ownership concentration, cybersecurity risks, and the proliferation of platforms acting outside of or out of compliance with applicable laws and regulations.

Yeah, that about covers it. FSOC recommends (again) that “Congress pass legislation to provide for the regulation of stablecoins and of the spot market for crypto-assets that are not securities.” [Press release; annual report, PDF]

IOSCO, the body of international securities regulators, released its final report on how to regulate DeFi, to go with its November recommendations on crypto markets in general. IOSCO’s nine recommendations for DeFi haven’t changed from the draft version — treat these like the instruments they appear to be, and pay attention to the man behind the curtain. These are recommendations for national regulators, not rules, but look at the DeFi task force — this was led by the US SEC. [IOSCO press release, PDF; IOSCO report, PDF]

London-based neobank Revolut is suspending UK crypto services — you can no longer buy crypto with the app — citing a new raft of FCA regulations, which go into force on January 8. [CityAM; CoinDesk]

Crypto exchange KuCoin has settled with New York. The NY Attorney General charged KuCoin in March for violating securities laws by offering security tokens — including tether — while not registering with NYAG. KuCoin has agreed to pay a $22 million fine — $5.3 million going to the NYAG and $16.77 million to refund New York customers. KuCoin will also leave the state. [Stipulation and consent order, PDF; Twitter, archive]

Montenegro plans to extradite Terraform Labs cofounder Do Kwon to either the US or South Korea, where he is wanted on charges related to the collapse of Terra’s stablecoin. Kwon was arrested in Montenegro in March. Originally it looked like Montenegro was going to pass him off to the US, but the case has been handed back to the High Court for review. [Bloomberg, archive; Sudovi, in Montenegrin]

Anatoly Legkodymov of the Bitzlato crypto exchange, a favorite of the darknet markets, has pleaded guilty in the US to unlicensed money transmission. Legkodymov was arrested in Miami back in January. He has agreed to shut down the exchange. [Press release]

The SEC posted a new investor alert on crypto securities with a very lengthy section on claims of proof of reserves and how misleading these can be. [Investor.gov; Twitter, archive]

Santa Tibanne

It’s been nearly ten years, but Mt. Gox creditors are reportedly starting to receive repayments — small amounts in Japanese yen via PayPal. [Cointelegraph; Twitter, archive]

Some payouts are apparently bitcoin payouts — with the creditors not receiving a proportionate share of the remaining bitcoins, but instead the yen value of the bitcoins when Mt. Gox collapsed in February 2014. This means a 100% recovery for creditors! — but much less actual money.

There are still 140,000 bitcoins from Mt. Gox waiting to be released. If payouts are made in bitcoins and not just yen, we expect that claimants will want to cash out as soon as possible. This could have adverse effects on the bitcoin price.

Trouble down t’ pit

In the Celsius Network bankruptcy, Judge Martin Glenn has approved the plan to start a “MiningCo” bitcoin miner with some of the bankruptcy estate. He says that “the MiningCo Transaction falls squarely within the terms of the confirmed Plan and does not constitute a modification.” [Doc 4171, PDF]

Bitcoin miners are racing to buy up more mining equipment before bitcoin issuance halves in April or May 2024. Here’s to the miners sending each other broke as fast as possible [FT, archive]

Riot Platforms subsidiary Whinstone sent its private security to Rhodium Enterprise’s plant in Rockdale, Texas, to remove Rhodium employees and shut down their 125MW bitcoin mining facility. The two mining companies have been brawling over an energy agreement they had made before prices went up. [Bitcoin Magazine]

More good news for bitcoin

The UK is setting up a crypto hub! ’Cos that’s definitely what the UK needs, and not a working economy or something. [CoinDesk]

Liquid is a bitcoin sidechain set up by Blockstream at the end of 2018. It was intended for crypto exchange settlement, to work around the blockchain being unusably slow. It sees very little use — “On a typical day, there are more tweets about Liquid than there are transactions on its network.” [Protos]

A16z, Coinbase, and the Winklevoss twins say they’ve raised $78 million as part of a new push to influence the 2024 elections. [Politico]

Little-known fact: coiners can donate to the PAC in tethers. All they have to do is send them via an opaque Nevada trust structure to hide the origins of the funds. And this is perfectly legal! [FPPC, PDF, p. 85, “nonmonetary items”]

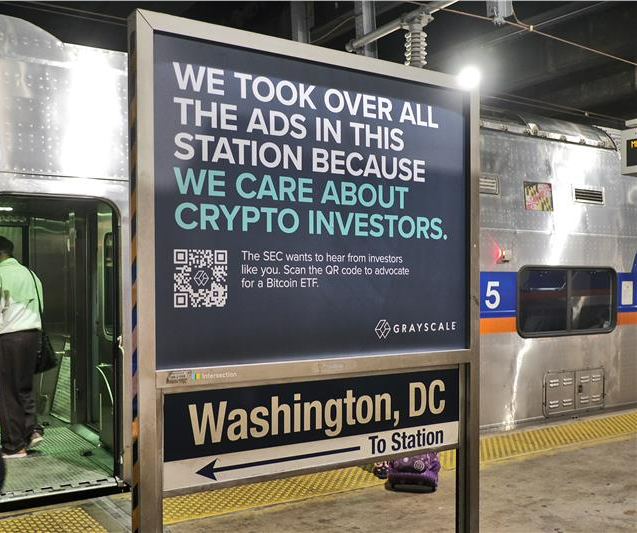

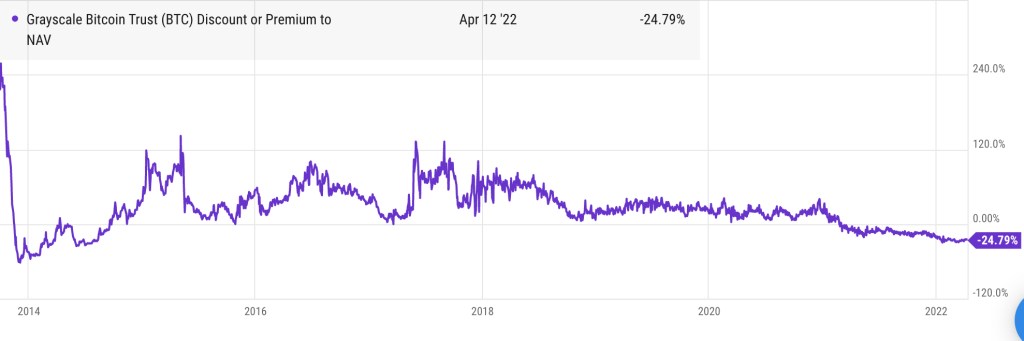

Ahead of the SEC’s deadline to rule on a bitcoin ETF, Barry Silbert, CEO of Digital Currency, has quietly stepped down from the board of DCG subsidiary and ETF applicant Grayscale and is no longer chairman, according to a recent SEC filing. Silbert will be replaced by Mark Shifke, the current DCG senior vice president of operations. US regulators are suing DCG over the Gemini Earn program co-run by its subsidiary Genesis. [Form 8-K]

Ordinals are an exciting new way to create NFTs on bitcoin! ’Cos who doesn’t want that? The bitcoin blockchain immediately clogged when it was actually used for stuff. Now TON, the blockchain that is totally not Telegram’s, no, no no, has ordinals — and it’s getting clogged too. [The Block]

Image: Mark Karpeles with aggrieved bitcoin trader outside Mt. Gox in Tokyo in 2014.