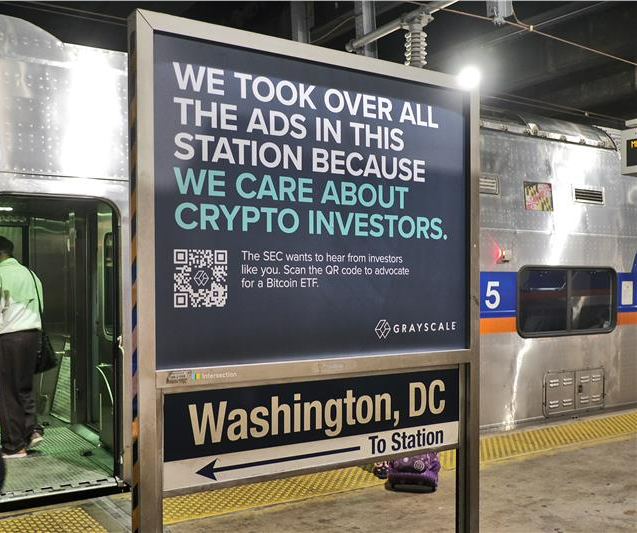

If you happen to be taking Amtrak and pass through Penn Station or Union Station, you will notice something unusual: every available ad space has been taken up by Grayscale.

“We care about crypto investors,” the crypto asset manager says in its ads. Grayscale is urging the public to write to the Securities and Exchange Commission and convince them to approve the first spot bitcoin ETF in the U.S.

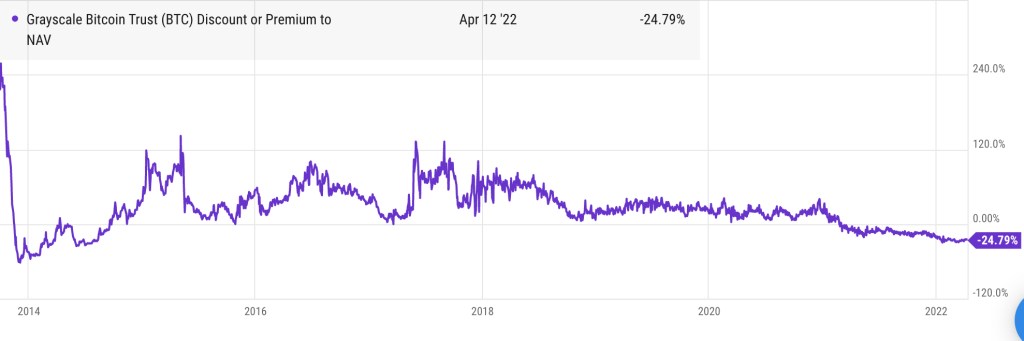

Grayscale wants to convert its Grayscale Bitcoin Trust (GBTC) into a bitcoin ETF after flooding the market with shares. GBTC is trading 25% below its net asset value, and investors are rightfully pissed off. Grayscale wants them to be upset with the SEC, but the regulator isn’t really to blame. If anything, the SEC should have warned the public about GBTC years ago.

Over the last eight years, Grayscale has been telling investors to buy shares of GBTC, advertising the fund as a way to get exposure to bitcoin without having to buy bitcoin.

Accredited investors plowed dollars (or maybe bitcoins) into the fund all through 2020, looking to take advantage of an arbitrage opportunity. They could buy in at NAV, and after a 6 to 12-month lockup, sell on the open market for a premium. All through 2020, that premium was around 18%, on average.

Everybody was happy until February 2021, when the Purpose bitcoin ETF launched in Canada. Unlike GBTC, which trades over-the-counter, Purpose trades on the Toronto Stock Exchange, close to NAV. At 1%, its management fees are half that of GBTC. Within a month of trading, Purpose quickly absorbed more than $1 billion worth of assets.

Demand for GBTC dropped off and its premium evaporated. Currently, 653,919 bitcoins (worth a face value of $26 billion) are stuck in an illiquid vehicle. Welcome to Grayscale’s Hotel California.

The plan all along, Grayscale claims, has been to convert GBTC into a bitcoin ETF. On October 19, 2021, NYSE Arca filed Form 19b-4 with the SEC. The regulator has until early July to respond.

In all probability, the SEC will reject the application, just as it has every single spot bitcoin ETF application put before it to date.

Bitcoin’s price is largely determined by wash-trades, whales controlling the market, and manipulation with tethers. SEC Chair Gary Gensler knows this. He taught a course in blockchain and money at MIT Sloan before his appointment by the Biden administration.

This is Grayscale’s second time around. It applied for a bitcoin ETF in 2016, but withdrew the application during the 2017 bitcoin bubble because “the regulatory environment for digital assets had not advanced to the point where such a product could successfully be brought to market.” Meanwhile, the trust’s assets under management grew as did Grayscale’s profits.

Closed-end fund

“Inflation is rising, we need to diversify!” a panicked woman tells her son over the phone in the middle of the night. “I’m buying crypto!” She hangs up. Her son rolls over in bed. The scene is from a series of TV commercials Grayscale ran in 2020 to convince the public that GBTC was a sound investment.

Digital Currency Group is the parent company of Grayscale. Both firms were founded by Barry Silbert. DCG is invested in hundreds of crypto firms. It owns crypto outlet CoinDesk, which essentially functions as a PR machine for the entire crypto industry.

Initially called the “Bitcoin Investment Trust,” GBTC launched in September 2013. It was promoted as an investment vehicle that would allow hedge funds and institutional investors to gain exposure to bitcoin, without having to deal with custody. Coinbase has been the custodian of the fund since 2019 when it bought Xapo, the previous custodian.

Legally, GBTC is a grantor trust, meaning it functions like a closed-end fund. Unlike a typical ETF, there is no mechanism to redeem the underlying asset. The SEC specifically stopped Grayscale from doing this in 2016. Grayscale can create new shares, but it can’t destroy shares to adjust for demand. Grayscale only takes bitcoin out to pay its whopping 2% annual fees, which currently amount to $200 million per year.

In contrast, an ETF trades like a stock on a national securities exchange, like NYSE Arca or Nasdaq. An ETF has a built-in creation and redemption mechanism that allows the shares to trade at NAV via arbitrage. Authorized participants (essentially, broker-dealers, like banks and trading firms) issue new shares when the ETF trades at a premium and redeem shares when they trade at a discount, making a profit on the spread.

How it all works

Grayscale periodically invites rich investors to pledge money into the fund in private placements at its discretion. The minimum investment is $50,000. Grayscale uses the cash to buy bitcoin and issues shares of GBTC in kind.

Investors can also pledge bitcoin directly — a great advantage if you happen to be a large holder who wants to unload your BTC without crashing the market. (More on this later.)

After a lockup period, investors can sell their GBTC on the open markets. Anyone can buy and sell GBTC on OTC Markets Group, the main over-the-counter marketplace, or via a brokerage account, like Schwab or Fidelity.

Up until early last year, GBTC has typically always traded at a premium on the open market. That premium occasionally soared to over 100%. During the 2017 bitcoin bubble, GBTC traded as high as 130% above NAV.

Why would anyone pay the premium? Many institutional investors can’t buy bitcoin directly for compliance reasons. And there are a lot of individuals who don’t want the headache of figuring out how to set up a bitcoin wallet. GBTC was initially the only option for getting exposure to BTC, without having to buy BTC, at least until bitcoin futures came along. However, bitcoin futures contracts came with their own risks, costs, and headaches. GBTC was easier.

In early 2020, GBTC became an SEC reporting company. This allowed investors who purchased shares in the trust’s private placement to sell their shares in 6 months instead of the previous 12 months. You could now make more money faster!

Unsurprisingly, the trust went into overdrive in 2020. Starting in January 2020 up to Feb. 23, 2021, Grayscale filed 35 reports with the SEC indicating that it sold additional shares to accredited investors, according to Morning Star’s Bobby Blue.

The trust’s holdings doubled from roughly 261,000 BTC in January 2020 to 544,000 BTC by mid-December 2020, per Arcane Research.

Red flags

Harris Kupperman, who operates a hedge fund, explained in a November 2020 blog post how GBTC’s arbitrage opportunity created a “reflexive Ponzi,” responsible for sending the price of bitcoin hyperbolic.

There were several versions of the arb. You could borrow money through a prime broker. You could use futures to hedge your bet. You could recycle your capital twice a year.

Every version involved Grayscale purchasing more bitcoin, thus increasing demand, widening the spread in the premium, and pushing the price of bitcoin ever higher. Between January 2020 and February 19, 2021, the price of BTC climbed from $7,000 to $56,000.

“When the spread is 26% wide and liquid to the tune of hundreds of millions per week, you can bet the biggest guys in finance are all over it,” Kupperman said. “As you can imagine, everyone big is putting on some version of this trade.”

Kupperman wasn’t the only person to raise alerts about the fund, which mainly benefited wealthy investors. As soon as GBTC launched, skeptics voiced their concerns.

“You can put a nice wrapper around a turd, and present it in a very well-manicured product to investors that you say is safe,” Barry Ritholtz, a wealth manager and founder of The Big Picture blog, told Verge. “But at the end of the day, it’s still crap.”

In September 2017, Citron Research called GBTC “the widow maker” and “the most dangerous way to own bitcoin.” Citron’s Andrew Left accurately predicted GBTC’s collapse:

“Citron believes that as new methods become available for investors to gain exposure to bitcoin — including traditional ETFs — that money will move to these regulated instruments and out of the uncertain waters of GBTC, which we believe can fall by 50% easily.”

Who holds GBTC?

The press has repeatedly credited Grayscale as a massive buyer of bitcoins, and evidence of institutional money entering the cryptoverse. This may not be the case.

Even though Grayscale states its holdings in dollars, it accepts deposits of bitcoins. A whale, or a good friend of Grayscale, can trade in their BTC for shares of GBTC, which they can flip six months later at well above the actual price of bitcoin.

The last time Grayscale broke out the numbers in Q3 2019, they said that the majority of deposited value into their family of trusts was in crypto, not dollars:

“Nearly 80% of inflows in 3Q19 were associated with contributions of digital assets into the Grayscale family of products ‘in-kind’ in exchange for shares, an acceleration of the recent trend, up from 71% in 2Q19.”

Grayscale stopped breaking out the percentage of crypto deposits into its trusts after 2019, and just stated everything in dollars. They may want to break out the numbers again, as this is something the SEC might be interested in.

Crypto lender BlockFi’s reliance on the GBTC arbitrage is well known as the source of their high bitcoin interest offering. Customers loan BlockFi their bitcoin, and BlockFi invests it into Grayscale’s trust. By the end of October 2020, a filing with the SEC revealed BlockFi had a 5% stake in all GBTC shares.

Here’s the problem: Now that GBTC prices are below the price of bitcoin, BlockFi won’t have enough cash to buy back the bitcoins that customers lent to them. BlockFi already had to pay a $100 million fine for allegedly selling unregistered securities in 2021.

As of September 2021, 47 mutual funds and SMAs held GBTC, according to Morning Star. Cathie Wood’s ArkInvest is one of the largest holders of GBTC. Along with Morgan Stanley, which held more than 13 million shares at the end of 2021.

Such a lovely place

Grayscale was happy to take investor money during the bitcoin bull runs of 2017 and 2020-21 and saturate the market with shares of GBTC. Anyone sitting on GBTC now is forced to take their losses, or hold out in the hopes Grayscale will do something to fix this.

Investors, many of whom are regular folks with GBTC in their IRAs, have every reason to be upset. Meanwhile, Grayscale is pointing the finger at the SEC as the reason we can’t have nice things.

Michael Sonnenshein, Grayscale’s chief executive, told Bloomberg he would even consider suing the regulator if Grayscale’s application to convert GBTC into a bitcoin ETF is denied.

Sonnenshein argues that because the SEC has approved bitcoin futures ETFs, it should also approve a bitcoin spot ETF.

This makes absolutely no sense. The two investment vehicles are totally different animals.

A bitcoin futures ETF indexes a bitcoin futures contract on the CME. It is a bet in dollars, paid in dollars. Nobody touches an actual bitcoin at any point. In contrast, Grayscale’s spot bitcoin ETF application represents an investment that is backed by bitcoins — not derivatives tied to it.

A spot bitcoin ETF is good for bitcoin, because it means more actual cash flowing into the cryptoverse. Crypto promoters are pushing hard for this. Bitcoin is a negative-sum game that relies on new supplies of fresh cash to keep it going.

But what happens if the SEC doesn’t approve Grayscale’s application?

Grayscale can issue more buybacks. In the fall of 2021, DCG began buying back over $1 billion worth of GBTC. In March 2022, it announced another $250 million in buybacks for Grayscale trusts. The effort had little impact. GBTC continued to trade well below the price of bitcoin.

As Morning Star points out, Grayscale has the power to make this right. It can redeem shares at NAV and simply return investors their cash or bitcoin. That is, if Grayscale really does care about crypto investors.

Grayscale offered a redemption program before 2016. However, the SEC issued a cease and desist order because the repurchases took place at the same time the trust was issuing new shares, in violation of Regulation M.

The situation is different now. Grayscale stopped issuing new shares in March 2021. That leaves the door open for it to pursue a redemption program and bring GBTC closer inline with the price of bitcoin.

I doubt this will ever happen. Grayscale is sitting on a cash cow. As long as it can redirect investor anger at the SEC, why change?

“There is no obligation to convert to an ETF,” David Fauchier, a fund manager at London’s Nickel Digital Asset, told me in a tweet. “If things stay as they are, they will print money into perpetuity basically, it’s a FANTASTIC business if BTC doesn’t zero.”

Fed by stimulus money, tethers, and a new grift in the form of NFTs, the price of bitcoin reached a record of nearly $69,000 in November 2021. Bitcoiners rah-rahed the moment.

However, the same network effects that brought BTC to its heights are working in reverse and can just as easily bring it back down again. At its current price of $40,000, amidst 8.5% inflation, bitcoin is not proving itself to be the inflation hedge Grayscale hyped it up to be.

It’s worth noting, that Barry Silbert left Grayscale in August 2021. Incidentally, Jeff Skilling jumped ship at Enron in August 2001, shortly before disaster hit, for some reason.

Submit your comments!

I encourage anyone reading this to submit your comments to the SEC regarding Grayscale’s application for a spot bitcoin ETF. Jorge Stolfi, a computer scientist in Brazil, has provided an excellent example, and so has David Rosenthal, also a computer scientist. You can submit your own comments here.

Did you enjoy this story? Consider supporting my work by subscribing to my Patreon account for as little as $5 a month. It’s the cost of a cup of coffee! Or, if you’re feeling generous, you can buy me a pound of coffee beans.