- By Amy Castor and David Gerard

- ONE WEIRD TRICK they don’t want you to know: Send us money! Here’s Amy’s Patreon, and here’s David’s. Sign up today!

- Our patrons can also get a couple of “Bitcoin: It Can’t Be That Stupid” stickers just by messaging one of us and asking.

- David has signed author copies of his books for sale.

- Sign up on Amy’s blog to see every new post she makes as it goes up, and click here and enter your email address for every new post on David’s blog as it goes up.

Bittrex takes a dive

Bittrex’s US entity, Desolation Holdings LLC, and Bittrex Malta filed for Chapter 11 bankruptcy in Delaware on May 8. The move came just weeks after Bittrex shut down its US operations, which was soon after they were sued by the SEC for trading securities without registering as a securities exchange. [Bloomberg; Bittrex; case docket]

The bankruptcy is apparently the fault of the SEC. The first-day declaration cites several SEC actions against other firms — and harps on about a “lack of regulatory clarity.” [Doc 9, PDF; first day declaration, PDF]

Bittrex says the bankruptcy will totally not impact its non-US operations, and funds are safe! Surely Bittrex didn’t do any commingling of company and customer funds like every other crypto exchange in trouble keeps turning out to have done.

The debts are largely fines levied against Bittrex by US government agencies — who are the only named creditors. OFAC is the largest creditor, owed $24.2 million. FinCEN is also a top 50 creditor with a $3.5 million claim. The SEC is listed with an undetermined amount of claims. [Doc 1, PDF]

Bittrex wishes to avail itself of a debtor-in-possession loan of 700 BTC so as to wind down Desolation and Bittrex Malta in an orderly manner and return customers’ funds. The loan will be from themselves — Aquila Holdings Inc, Bittrex’s parent entity, which is not in bankruptcy. [Liquidation plan, PDF]

The precedence of creditors (who gets paid back first) would be: themselves, then the customers, then the US government. That’s novel.

Michel de Cryptadamus notes several other interesting wrinkles. Bittrex’s US gross (not net) revenue for 2022 was $17 million, against the $30 million in government fines. “Several states alleged that BUS was undercapitalized and demanded that BUS immediately surrender its money transmitter licenses in those states.” Bittrex’s complicated corporate structure is reminiscent of FTX. And Bittrex may also be trying to protect the salaries of Bittrex executives from being seized by the SEC. [Twitter, archive]

Michel thinks the whole filing is a massive troll. We concur. The idea seems to be for Bittrex to set up a sacrificial entity to pay back their customers but stiff the US government. We are unconvinced that the government agencies will be inclined to let this one slide.

Good news for Binance

Market makers are leaving Binance US. Jane Street Group in New York and Jump Trading in Chicago — two of the world’s top commodities market makers — are pulling back from crypto in the US as regulators crack down on the industry. Their business in normal commodities is much larger, and they could do without the regulatory heat. [Bloomberg]

The Department of Justice is investigating Binance for possible violations of US sanctions against Russia. There’s already plenty of evidence that Binance has committed sanctions violations. Binance was the final destination for millions in funds from Bitzlato, an exchange shut down for money laundering. Now Dirty Bubble writes that Binance partner Advcash may be facilitating transfers from Russian banks. [Dirty Bubble]

Binance is withdrawing from Canada, owing to a surfeit of regulatory clarity. [Twitter, archive; Reuters]

Bitcoin has been trading at a premium of up to $650 on Binance US. A premium like this is usually an indication that people can’t get their dollars out of the exchange, so they buy bitcoins and move those to another exchange to cash out. [CoinDesk]

We also saw bitcoin trading at a premium on Mt. Gox just before that exchange collapsed in 2014, and the same with QuadrigaCX, which imploded in 2019. Naïve traders who don’t understand what’s happening will often move their BTC to the dying exchange, thinking it’s an arbitrage opportunity.

Trading at a premium is not a good sign, but a worse sign is when people complain they can’t get their crypto off an exchange. Binance US has long had a reputation for demanding arbitrary new KYC documentation when users try to withdraw.

Monkey laundering comes to bitcoin

Binance paused withdrawals twice on Sunday, May 7. The first time was due to a “congestion issue.” Later in the day, Binance paused withdrawals again due to a “large volume of pending transactions.” [Twitter, archive; Twitter, archive]

For once, Binance might have been on the level. On May 7, the bitcoin mempool was clogged with 400,000 transactions waiting to be processed, and transaction fees surged.

In bitcoin, the mempool, or memory pool, is where pending transactions pile up before a miner selects the most profitable ones and puts them together as a proposed block. If your transaction stays in the mempool too long, it gets dropped.

The best way to break a blockchain is to try to use it for something. In this case, some idiot worked out how to do NFTs on bitcoin.

“Ordinals” are a new way to create NFTs on bitcoin by linking a JPEG, video, or another image type to a satoshi, the smallest denomination of a bitcoin. Ordinals came out in January, and bitcoin has been filled with monkey pictures since. Bitcoin maxis condemn ordinals as a conspiracy to destroy bitcoin by using the network for a purpose. [Decrypt]

Child genius, adult moron

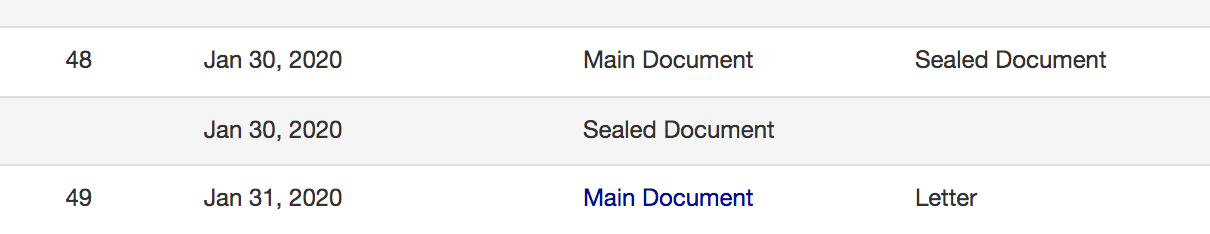

Sam Bankman-Fried’s defense team is trying to strike 10 of the 13 criminal charges against their client. They argue that the Bahamas did not agree to several of the charges — including one claim that Sam hid millions of dollars in political donations — while other claims didn’t meet the legal requirements of the underlying criminal statutes. [Docket, see filings 137-147]

The facts against SBF are solid. There’s no reason to doubt that Sam did everything the US claims. So the defense seems to be going for unreasonable doubt and hoping they have a dumb enough jury member or two.

Former federal prosecutor Sean Shecter of Lewis Brisbois says SBF’s lawyers want to preserve an appeal, so they have to try everything they can think of, “even if it involves throwing spaghetti against the wall.” He thinks the defense is likely hoping that the government gives up “nuggets of information” in response to the motions. [Law360, paywall]

Prosecutors have until May 29 to respond. Judge Lewis Kaplan will hear oral arguments on June 15.

The IRS has hit the FTX companies with a $44 billion tax bill, with the largest chunk being $20.4 billion for Alameda. It looks like the IRS reclassified all FTX employees from contractors to employees and charged for unpaid employment taxes. [Docket, see filings April 27, 28; IRS Alameda claim, PDF; CoinDesk]

The IRS has not released its calculations in detail, but we’d assume the bill is inflated by fraud (fictitious profits), penalties, and interest. John Jay Ray is sure to fight this. But even if Ray gets that amount substantially reduced, this is still sure to be a huge hit for FTX creditors.

The IRS claims are treated as unsecured — but they will receive priority status as ordinary and necessary business expenses of the bankruptcy estate. So the IRS will come before ordinary unsecured creditors.

The searing light of regulatory clarity

Ishan Wahi will spend two years in prison for insider trading as a former product manager at Coinbase. He previously admitted to passing on confidential information from Coinbase to his brother and friend, who profited from the tips. [WSJ, paywall; DOJ press release]

In Estonia, nearly 400 VASPs (“virtual asset service providers,” the FATF term for companies dealing in crypto) have shut down or had their licenses revoked after the government’s recently enhanced terrorist financing prevention and anti-money laundering laws came into effect in March. [Protos; Estonia Financial Intelligence Unit]

Bakkt has delisted a bunch of tokens from the institutional crypto business they bought from Apex Crypto, including several that the SEC has indicated it considers securities. “Our review process ensures those interests are best served when we contemplate the most up-to-date regulatory guidance.” [CoinDesk]

John Reed Stark thinks an SEC action against Coinbase is imminent. He explains the regulations and how they work in detail and why Coinbase doesn’t stand a chance.

Stark notes also that Coinbase’s “regulatory estoppel” claim — that the SEC approving their S-1 public offering means the SEC must have approved the exchange dealing in securities — is directly contradicted by the mandatory “no approval clause” in the S-1: “Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.” Whoops. [LinkedIn]

Unvaxxed bitcoin is the new bitcoin

QuadrigaCX bankruptcy claimants will get 13% on the dollar. They will be paid out the dollar value of their crypto at the time Quadriga filed for bankruptcy — April 15, 2019, when bitcoin was in the toilet.

It’s amazing that creditors will even get back that much. Most of the Quadriga money was gambled away by cofounder Gerald Cotten and filched by shady payment processors. We’re surprised no criminal charges were filed — but then, most of the money was stolen by a guy who is supposedly dead. [EY notice, PDF; CoinDesk]

Arthur Hayes of BitMEX has been tweeting at Three Arrows Capital co-founders Su Zhu and Kyle Davies because 3AC owes him $6 million following its collapse in June 2022. Rather than returning Hayes’ money, 3AC cofounder Su Zhu has filed a Singapore restraining order to prohibit Hayes from using “threatening, abusive or insulting words” and “making any threatening, abusive or insulting communication, that would cause the Applicant harassment, alarm or distress.” [Twitter, archive; Twitter, archive; CoinDesk]

BlockFi users discover that BlockFi owned their coins. Bankruptcy Judge Michael Kaplan ruled that BlockFi users who had money in BlockFi’s interest-bearing accounts gave up ownership of their bitcoins — all they owned was a liability from BlockFi — and all of the $300 million in crypto deposits is now the property of the bankruptcy estate, as is normal. [Bloomberg]

P2P exchange Paxful has resumed operations after it shut down last month amidst a messy dispute between cofounders Ray Youssef and Artur Schaback. The entire operation has been comedy gold. Youssef and Schaback say the exchange is now owned by a custodian — who they never actually name — and the custodian, Schabeck, and Youseff all serve as directors. [Paxful, archive; CoinDesk]

In the crypto bubble, Miami crypto companies boomed with the enthusiastic support of Mayor Francis Suarez. Now there’s empty real estate and lawsuits. “Most of crypto was a pyramid scheme,” said local businessman Ryan Kirkley. Suarez is now trying to lure tech startups into Miami instead. [WSJ, paywalled]

Robert F. Kennedy Jr., who is running for US President on the gibbering insane Twitter blue check conspiracy theorist ticket, will be making the first appearance of his campaign giving the keynote at Bitcoin 2023 in Miami later this month. So, on brand then. [Twitter; NBC]

A propaganda movie is in the works for bitcoin mining — because consuming a country’s worth of electricity is actually good news for bitcoin. Based on the trailer, the film is amazing, but not in a good way. [Dirty Coin the Movie]

Media stardom

Amy spoke to Bloomberg about the growing ranks of crypto skeptics after the crypto collapse: “There were a handful of us before, screaming into the abyss. Now there’s a lot more.” We’ll just be over here, quietly being right. [Bloomberg]